Building the DNA of a Successful Momentum Investor - Navy Vijay Ramavat

A Short Key Takeaways and Insights from Face2Face Podcast between Navy Vijay Ramavat and Vivek Bajaj.

"In this issue, I'm breaking down the most impactful lessons I learned from the Podcast Between Navy Vijay Ramavat and Vivek Bajaj.

Whether you're looking to deepen your understanding of Momentum Investor or simply curious about what stood out, here's a concise overview of the video that helped broaden my perspective.

Core Philosophy of Momentum Investing

Momentum investing focuses on short to medium-term opportunities, targeting the best-performing stocks that are in their best phase. The key principles include:

✅ Staying in cash when markets are weak – sitting on cash provides fresh investment opportunities.

✅ Re-entering stocks at the right time – avoiding emotional attachment and focusing on market trends.

✅ Understanding price trajectory – identifying strong price movements backed by fundamentals.

✅ Proper money management – risk allocation and disciplined exits.

Understanding Market Cycles Through Human Age Phases

Navy Vijay compares stock behaviour to human growth:

📌 Toddler to Teen Stocks – Less known, small and mid-cap, hitting new highs.

📌 Adult Stocks – Well-known, experienced a significant price increase.

📌 Rejuvenated Stocks – Those that recover due to sector tailwinds, acquisitions, or new management.

By recognizing where a stock stands in its lifecycle, investors can make timely entry and exit decisions.

The Evolution of a Trader

A successful trader evolves through learning and experience:

📌 Find a Guru – Learn from experts.

📌 Read Books – Constant learning is crucial.

📌 Deploy Real Money – Start small but get hands-on experience.

📌 Have an Entry & Exit Plan – Every trade must have a defined strategy.

Essential Guidelines for Aspiring Traders

❌ Avoid futures trading for the first 3 years.

❌ Avoid options trading unless you're a full-time trader.

❌ Avoid leverage until you have at least 2 years of success in the markets.

Momentum Investing Tools & Patterns

Momentum traders rely on technical patterns and fundamental triggers:

🔹 123 Pattern – Helps identify trend reversals.

🔹 Pennant Pattern – A breakout trade setup that follows a sharp rally.

🔹 Flag Pattern – A consolidation phase before a strong breakout.

🔹 Cup & Handle Pattern – A bullish continuation pattern.

🔹 IPO Bases – Identifying strong IPO stocks with potential breakouts.

By recognizing these patterns early, traders can capitalize on high-probability moves.

Risk Management & Exit Strategies

📌 Define Your Risk – Not knowing the risk is the biggest risk.

📌 Avoid Risk of Ruin – Never take trades that can wipe out your portfolio.

📌 Use Stop-Loss Logic –

Move stop-loss to cost after a 5-10% gain.

Exit using EMAs (10, 21, 50-day) for trend confirmation.

Use last swing lows to exit with predefined quantity reductions (50%, 30%, 20%).

When to Book Profits?

✅ In extreme movements (euphoria phases).

✅ During big events (elections, policy changes).

✅ If profits accumulate quickly, start trimming.

✅ Use trailing stop-losses (5-10%) during strong uptrends.

Portfolio Allocation Strategy

A momentum portfolio should be well-diversified yet focused:

📌 Max 25 stocks in a ₹10 lakh portfolio.

📌 Individual stock exposure is capped at 10-20%.

📌 Stage-based Allocation:

Base Breakouts – 1-3% per stock.

Confirmed Breakouts – 2-6% per stock.

Follow-up Breakouts – 0.5-1% per stock.

Capital Management Rules

✔ If MTM (Mark-to-Market) is not increasing, reduce exposure.

✔ If losses persist for a month or quarter, shift to 100% cash.

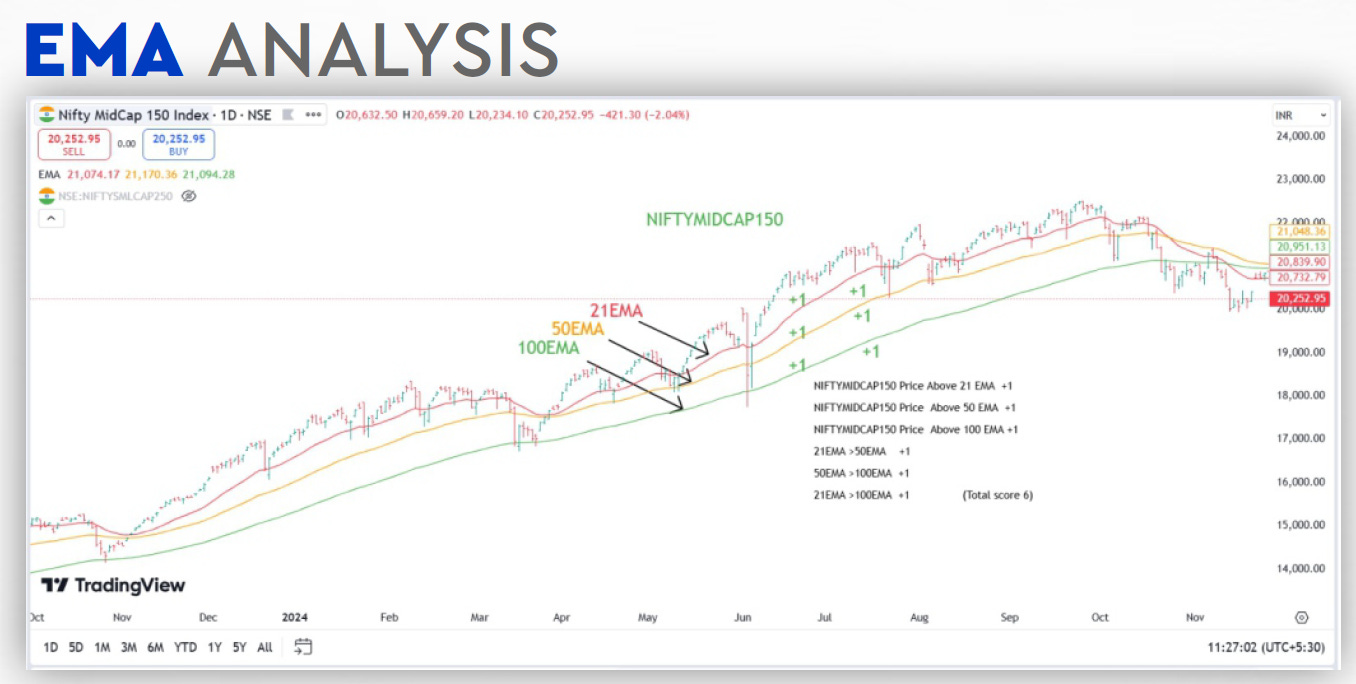

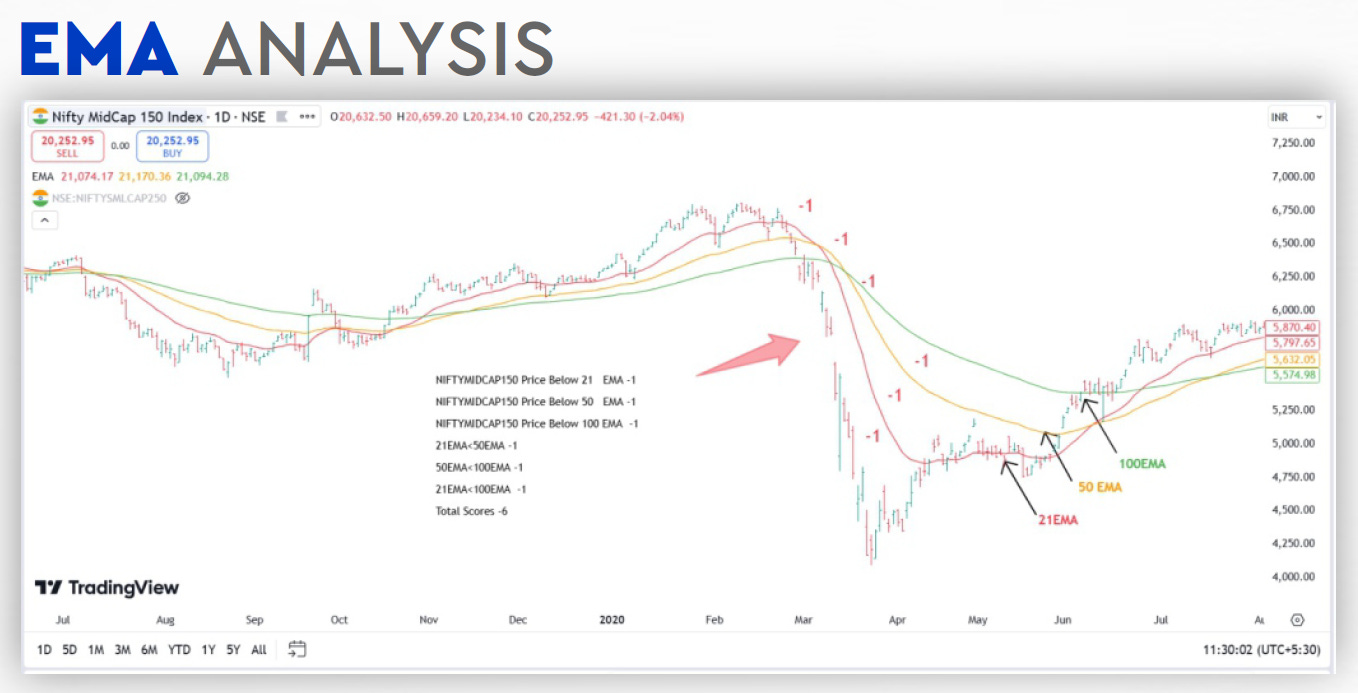

EMA-Based Allocation Model

Navy Vijay emphasizes Exponential Moving Averages (EMA) for dynamic allocation:

📌 Price vs EMA scoring system determines stock strength.

📌 Higher scores indicate bullish momentum and lower scores indicate bearish risk.

📌 This helps in portfolio balancing and position sizing.

RULES FOR EMA ANALYSIS

Scoring System:

If price > EMA level → Assign +1

If price < EMA level → Assign -1

If EMA 21> 100 EMA → Assign +1

If EMA 21> 50 EMA → Assign +1

If EMA 50> 50 EMA → Assign +1

If EMA 21 < 100 EMA → Assign -1

If EMA 21 < 50 EMA → Assign -1

If EMA 50 < 50 EMA → Assign -1

Summing Up the Scores:

The scores for Above EMA and Below EMA are summed for each stock/index.

A positive score indicates a bullish trend (the price is above multiple EMAs).

A negative score indicates a bearish trend (the price is below multiple EMAs).

Common Fallacies & Market Realities

🚫 Expensive stocks can become more expensive – momentum drives valuation.

🚫 Best past performers may not be the best future performers – don’t hold onto laggards.

🚫 Cash is a position – sometimes the best move is to wait.

🚫 Stop-losses protect capital – losing small is key to long-term success.

🚫 Falling stocks rarely make you money – strong stocks give better returns faster.

Learning Principles for Traders

🔹 You don’t make money; the market gives you money.

🔹 Patience leads to better entry points.

🔹 Excess information should be used for validation, not execution.

🔹 Only 4-5 out of 10 trades need to be correct to be profitable.

Final Takeaways: Implanting the DNA of a Successful Trader

✅ Trade with a well-defined philosophy.

✅ Recognize stock cycles and patterns.

✅ Avoid unnecessary risks and use proper money management.

✅ Be disciplined in exits and protect capital.

✅ Learn continuously and adapt.

Momentum investing requires skill, discipline, and patience. By following these principles, traders can build a robust trading strategy and consistently outperform the markets.

Would love to hear your thoughts! Do you practice momentum investing? Share your experiences in the comments. 🚀