Decoding Price vs Value: How Shankar Nath Spots Multibagger Stocks 📈💡🚀

The Key to Unlocking Growth Potential in the Stock Market 🎯📊💰

In this issue, I'm breaking down the most impactful lessons I learned from the Masters in One Podcast Between Shankar Nath and Vijay Thakkar.

Introduction

"Price is what you pay, value is what you get." This famous Warren Buffett quote is often repeated, but what does it truly mean? Many investors, especially beginners, struggle to differentiate between a stock’s price and its intrinsic value. 🤔📉📈

At first glance, a stock trading at ₹100 might seem cheaper than one trading at ₹500. However, if the ₹100 stock belongs to a company with weak fundamentals and the ₹500 stock is backed by strong earnings growth, the latter could be the better investment. Identifying this difference is the key to wealth creation in the stock market.

In this newsletter, we break down this fundamental concept, explore how successful investors identify undervalued opportunities, and examine real-life case studies of companies that have rewarded those who understood this difference. We will also discuss how different investing styles—from value investing to momentum trading—can be blended for a robust investment strategy. 📚🎯💵

Understanding Price vs Value 📊🧐💰

The stock price is simply what the market is willing to pay at a given time. Value, on the other hand, is derived from the company’s fundamentals—its earnings growth, revenue visibility, market position, and future potential. Smart investors don’t just look at the current price; they analyze a company’s underlying worth and its growth trajectory.

For example, consider two perspectives:

A retail investor sees a stock going from ₹100 to ₹400 and assumes it is now expensive.

A fundamental investor evaluates its financials, growth potential, and margins and may determine that even at ₹400, the stock is still undervalued.

This is where successful investing lies: spotting value where others only see price.

One common mistake investors make is focusing too much on price movements without assessing whether the company’s intrinsic value has changed. A stock may decline 30% due to temporary market conditions, but if its fundamentals remain strong, it could present a buying opportunity rather than a reason to panic.

Four Key Factors for Identifying Value Stocks

Revenue Visibility 📈🔮💰

Revenue visibility refers to the ability to predict a company’s future earnings growth based on its existing orders, expansion plans, or industry trends. If a company is increasing its production capacity, launching new products, or securing long-term contracts, it provides strong revenue visibility. Investors should look for companies where growth in revenue is sustainable over the next one or two years.Stable or Expanding Margins 📊💡📈

A company with stable or increasing profit margins is usually well-managed and has strong pricing power. Expanding margins indicate that the company is improving efficiency, cutting costs, or moving towards higher-value products. This leads to higher profits even if revenue remains constant. Investors should prefer businesses that maintain or grow their margins over time.Competitive Advantage & Market Position 🏆🏛️🚀

Companies with a strong competitive advantage, such as monopolies or those with unique products, can sustain higher profitability for longer periods. These firms often have strong brand recognition, cost advantages, or high entry barriers for competitors. A solid market position enables them to command premium pricing and ensures long-term stability in earnings.Valuation Metrics Beyond PE Ratio 📊📏💰

Many investors focus solely on the PE ratio, but a deeper approach is required to assess true value. The PEG ratio, EV/EBITDA, and return on capital employed (ROCE) provide better insights into a stock’s fair valuation. A low PEG ratio (below 1) suggests that the stock is undervalued relative to its earnings growth potential, making it a great pick for value investors.

Case Studies: Identifying Hidden Gems

Mazagon Dock Shipbuilders (Asset-Based Value) 🏗️⚓📈

Mazagon Dock Shipbuilders was a classic case of an asset-based valuation opportunity. In 2020, the company had a market cap of around ₹6,000-7,000 crores, but its cash reserves alone were ₹11,000 crores. Essentially, investors were able to buy the stock at a discount to the company’s net cash position. With zero debt and strong financial backing, the stock has surged significantly, proving that hidden asset value can lead to massive gains when recognized by the market.

Sky Gold (Growth-Driven Value) 💎🏭🚀

Sky Gold’s story exemplifies how expansion can unlock substantial value. The company transitioned from operating in a 25,000 sq. ft. facility to a much larger 75,000 sq. ft. production unit. This expansion significantly increased production capacity and revenue potential. The stock initially appeared expensive to traders, but those who understood the business fundamentals saw the value. As expected, once earnings started reflecting the expansion’s impact, the stock price skyrocketed.

Apar Industries (Missed Opportunity Example) ⚠️📉🤦

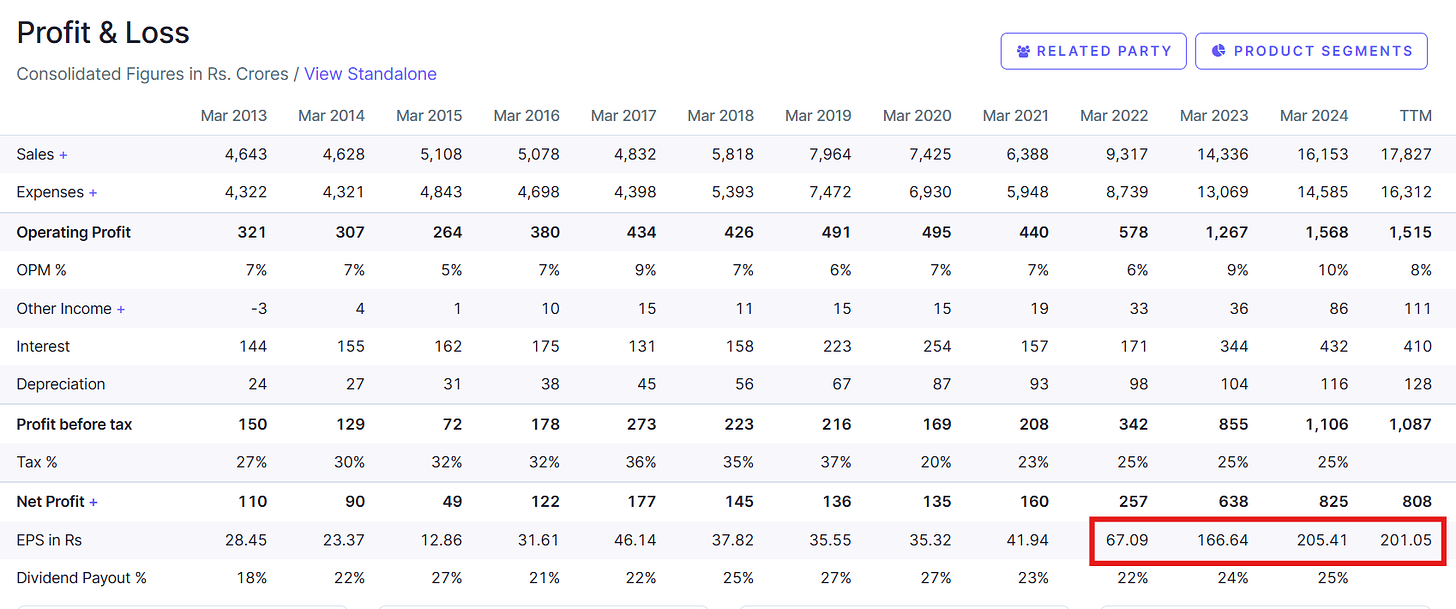

Many investors focus solely on price movements and book profits too early, missing long-term wealth creation. Apar Industries was one such case. An investor bought the stock at ₹900 in early 2022 and exited at ₹1,600, thinking they had made a great profit. However, the stock continued its rally and went above ₹12,000, driven by strong earnings growth. This highlights the importance of understanding a company’s long-term potential rather than making decisions solely based on price fluctuations.

Key Takeaways

✅ Price is what you pay; value is what you get. Don’t judge a stock’s worth by its current price alone.

✅ Look for revenue visibility and margin expansion. These are strong indicators of sustainable growth.

✅ Competitive advantage matters. Monopoly-like businesses have long-term pricing power.

✅ Valuation metrics like the PEG Ratio can provide deeper insights. Forward-looking metrics help assess whether a stock is truly expensive or cheap.

✅ Read earnings reports and listen to conference calls. Understanding business fundamentals is key to spotting high-growth opportunities.

✅ Don’t sell too soon! Exiting a multibagger too early due to price movements can lead to missed wealth-building opportunities.

✅ A combination of technical and fundamental analysis can enhance investing decisions. Successful investors blend multiple strategies to maximize returns.

Final Thoughts

Investing is an art that requires blending multiple strategies—technical analysis, fundamental research, and a deep understanding of price vs. value. As investors, we must focus on long-term value creation rather than short-term price fluctuations.

Many great investors have mastered different approaches—some prioritize momentum trading, others look at earnings visibility and some focus on asset-based valuation. However, the most successful ones develop their unique investing style by integrating different methodologies.

Whether you’re a technical trader or a value investor, integrating fundamental insights into your strategy can significantly improve your investing outcomes. If you found this newsletter valuable, feel free to share it with fellow investors! Stay tuned for more insights in the next edition.

Acknowledgements 🙌📖💡

A special thank you to Vijay Thakkar and Shankar Nath for their insightful discussion that inspired this newsletter. I truly appreciate their efforts in educating investors and fostering meaningful discussions in the finance community. 🙏📊💡

📩 Join my exclusive newsletter and subscribe to my Substack for more insightful finance content! 📩