How the Collapse of Our Biggest Engine Could Trigger India’s Own “2008 Moment”

India's IT Services: The Crumbling Pillar of Growth?

Beyond The Ticker | 27th Aug 2025 | Issue: 07

Dear Readers,

Firstly, Happy Ganesh Chaturthi and Michhami Dukkadam! If I have hurt you knowingly or unknowingly, in thought, word, or action, I seek your forgiveness on this day of Jain Samvatsari, and May Lord Ganesh bless you with success and good fortune.

This isn’t your typical newsletter filled with jargon and optimism. This is a warning—an urgent one.

For nearly 30 years, India’s IT services industry has been our economic lifeline—fueling jobs, building the middle class, attracting foreign capital, and giving India a seat at the global economic table. But the same lifeline is showing cracks.

In an age where Artificial Intelligence is rewriting the rules of value creation, our once mighty engine is slowing, faltering, and perhaps heading towards obsolescence.

“If IT sneezes, the Indian economy won’t just catch a cold—it risks pneumonia.”

This matters to you because your wealth, your job security, your family’s future, and the country’s trajectory are tied to what happens next. Stick with me, because the story isn’t about IT companies alone—it’s about the fate of an entire nation.

Why IT Mattered More Than Anything Else

For decades, Indian IT was not just an industry. It was the industry.

$250 Billion Juggernaut: India’s crown jewel, employing over 5 million people and exporting services worldwide.

The Middle-Class Dream Builder: TCS, Infosys, Wipro, HCLTech—household names that lifted millions of families into prosperity, enabling home ownership, car purchases, and better education for children.

The Multiplier Effect: Every rupee earned in IT was spent on housing, consumer goods, education, healthcare, and more. A TCS engineer’s new apartment in Bangalore wasn’t just a personal asset—it meant business for real estate, construction workers, furniture sellers, and banks.

The Domino Fear: If IT falters, the chain of demand breaks. Economists warn that GDP could shrink from 7–8% growth to a sobering 4.5–5%. And in a nation where 1 million youth enter the job market every month, that drop isn’t academic—it’s catastrophic.

How Power Shifted Through Time

History reminds us that economic dominance is never permanent. It evolves.

The Agrarian Age: 5,000 years ago, wealth came from land and labour. India and China thrived because of fertile soil and massive populations.

The Industrial Revolution: Machines replaced manual effort. Steam, coal, and steel propelled nations like Britain and the US into dominance. India, lacking its own machines, was left behind.

The Digital Age: The late 20th century marked the rise of “mind-based companies.” Software became the new steel. Indian IT seized the outsourcing wave, offering cost-effective brainpower to the world.

The AI Storm: Today, AI threatens to do to white-collar work what steam engines did to manual labour. Automated coding, algorithmic trading, AI-driven customer service—these are not future concepts. They’re here, eroding the very base of Indian IT services.

The State of IT Today: An Industry at Crossroads

The numbers tell a sobering story.

An Ageing Giant: Employee growth has stagnated. Salary increases are trailing inflation, reducing real purchasing power.

Ceiling Reached: Analysts warn bluntly—high growth will not return. The “hyper-growth phase” is history. At best, the future is flat.

The Vanishing Middle: Companies are laying off mid-level employees aged 40–55, once the backbone of project delivery, as AI tools make them redundant.

Stock Market Reality: Post-ChatGPT, Microsoft’s market cap soared by $1 trillion, but Infosys and TCS? Stuck in neutral.

The market has spoken—Indian IT is mature, not innovative.

AI’s Shadow: What the Next Decade Looks Like

Artificial Intelligence is not “just another technology.” It’s a tectonic shift, as big as the Industrial Revolution. In the next decade, artificial intelligence will fundamentally reshape India's IT-driven economy, eliminating millions of routine roles, polarizing talent demand, and driving wealth toward global AI leaders unless India adapts rapidly.

Jobs on the Chopping Block:

Repetitive cognitive tasks—software testing, bug fixing, routine coding—are being automated. The entry-level coder, once the pride of Indian engineering colleges, is endangered.

Roles in testing, documentation, and basic coding are among the most vulnerable, as AI systems can automate tasks once handled by armies of software engineers.

Recent studies warn that up to 69% of jobs in India, mostly routine and low-skill roles, could face automation risk within 20 years—threatening large swathes of IT/BPM and service work. (Source)

From Crowds to Elites:

The world no longer values armies of average engineers. It wants a handful of AI architects who can build systems that scale exponentially. One Mira Murati is worth more than 10,000 generic coders.

The "mass engineer" model is breaking; companies worldwide now favour elite AI architects, specialized AI programmers, and data scientists over generic coders.

NASSCOM reports that 80% of Indian IT firms aim to hire advanced AI talent, not entry-level programmers—fueling a new race for specialized skill sets. (Source)

Economic Earthquake:

If even 1–4 million IT jobs vanish in the next 8–10 years, the ripple effects will be seismic. Think of unemployment crises in urban centers, falling demand for housing, and rising stress on social systems.

Cities like Bangalore, Pune, and Hyderabad may suffer sharply reduced consumption, housing demand, and migration flows, as workers respond with spending caution—the “cortisol effect” freezing once vibrant tech-driven city economies.

The Cortisol Economy:

Fear is contagious. When employees fear layoffs, they stop buying cars, postpone home purchases, and cut down on luxuries.

This “cortisol effect” suppresses consumption, leading to an economic slowdown even before actual layoffs happen.

Post-IT layoffs, local businesses—from real estate to retail—face declines due to widespread financial anxiety.

A Split World:

AI-first companies like Microsoft, Nvidia, and OpenAI are minting wealth. Indian IT giants are flatlining. This isn’t just a divergence—it’s a warning flare.

An absence of transformation in Indian IT risks stagnation as global value accumulates with tech superpowers rather than legacy service providers.

Long-Term Risk & Solutions:

If Indian IT cannot pivot from services to products, the economy faces a downward spiral reminiscent of the 2008 global financial contagion. Only this time, the epicenter could be at home.

Policy, education reform, and skill upgradation are urgent, with government and private Sector efforts needed to shift millions toward AI-adjacent, practical-tech, and resilient fields.

AI is not just another trend; it is an epochal shift that puts India's economic future at a crossroads—only major adaptation, Policy Reforms, and Private Sector innovation will stave off mass unemployment, a consumption freeze, and the risk of IT-led stagnation.

The Domino Effect: What if IT Crashes Like 2008?

Let’s play out a chilling scenario. A severe IT crash in India, analogous to 2008, would trigger a multi-layered economic crisis—shrinking employment, collapsing real estate in tech hubs, stock market turmoil, a potential credit/banking shock, and a structural GDP slowdown—imposing risks not seen since India's IT boom began.

Job Loss Avalanche:

The Indian IT sector employs nearly 2.8 million people directly. Imagine IT employment shrinking by 25%. That’s over a million high-paying jobs evaporating. Each job lost means four to five dependents affected.

Job losses of 20–30% would mean a reduction in hundreds of thousands, possibly over a million, high-salary jobs, which would sharply reduce aggregate income, discretionary spending, and consumer confidence. (Source)

Urban Real Estate Implosion:

In Bengaluru, tech job losses in the first half of 2025 alone topped 65,000; this led to a 15–20% fall in rental prices, record-high vacancies, and landlords struggling to find tenants. (Source)

Cities like Bangalore, Pune, Hyderabad, and Chennai—built on IT wealth—would see housing demand collapse. Prices could fall 20–40%, eroding household wealth.

Many affected workers move to cheaper areas or leave the city altogether, while high-end housing sales stagnate, and even paying guest accommodations close down.

This dynamic, if replicated at scale across Bangalore, Pune, Hyderabad, and other tech-centric cities, could cascade into major corrections in both rental and home prices. (Source)

Stock Market Slide:

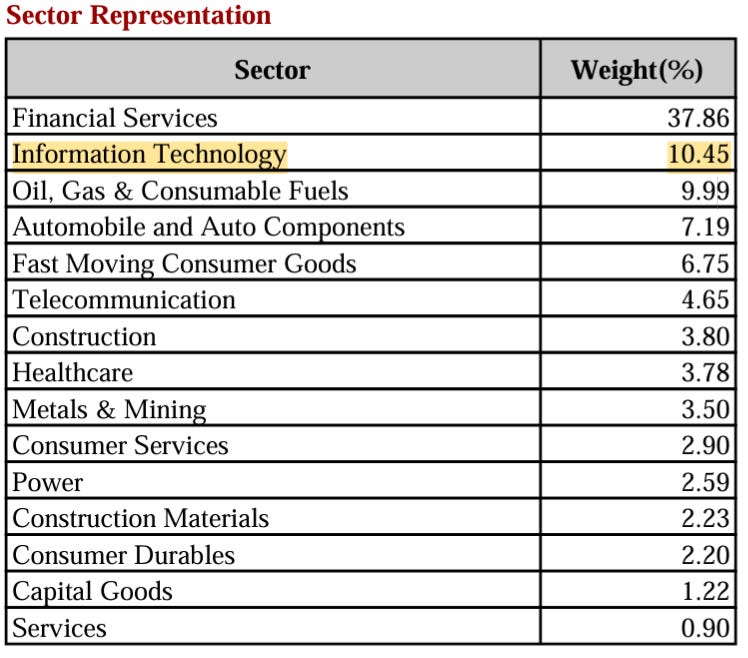

IT services make up a large slice of the Nifty and Sensex. A fall in these giants would drag the indices, wiping out investor wealth, from mutual funds to retirement portfolios and possibly spur forced liquidations across portfolios, disproportionately impacting mid- and large-cap funds with IT sector exposure.

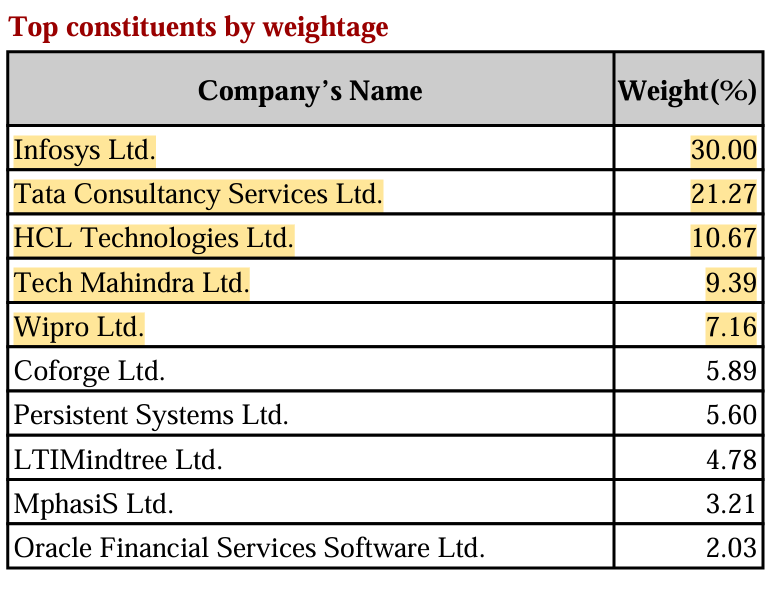

IT stocks are core components of both the Nifty IT Index (Infosys, TCS, HCL, Wipro, Tech Mahindra together comprise over 75% weight within the sector index) and the broader benchmark indices

The Banking Strain:

IT workers form 10–16% of Indian private banks’ salaried customer base and are among the largest home, personal, and credit card loan borrowers.

Salaries falling means EMIs are unpaid. Rising NPAs could squeeze banks, triggering a credit crunch. Recall the US subprime crisis—except this time, the trigger isn’t mortgages but jobs.

Tech job cuts have already caused an 8–12% contraction in private sector banks’ earnings projections. (Source)

GDP in Freefall:

Historically, IT & IT-enabled services contributed nearly 7% of India’s GDP and powered services/export growth. (Source)

Without a replacement engine, India’s GDP could sink below 5%. For a young, aspirational nation, that’s economic depression is especially concerning for India’s youth, a rapidly urbanizing workforce. It’s not just a slowdown.

Migration outflows, collapsing urban consumption, and a weakened financial system would further entrench this GDP slowdown.

The Social Unrest Factor:

Millions of educated but unemployed youth could fuel frustration, migration pressures, and even political instability.

A 2008-scale IT crash in India would unleash widespread social and economic distress, punching holes through jobs, real estate, financial markets, banks, and the growth engine itself—with multiplier effects rippling across every sector of the economy.

Charting a Survival Path

So, is doom inevitable? Not if India acts now.

Diversify Engines: Invest aggressively in manufacturing, green energy, defence tech, and biotech. IT cannot be the only wheel turning.

From Service to Product Nation: The future belongs to countries that build. India must move beyond being the world’s back office to becoming a product powerhouse.

Respect and fund innovators who think differently—the dreamers often dismissed as crazy. They are our potential Steve Jobs and Elon Musks.

Reform Education: Coding alone won’t save us. We need grit, creativity, problem-solving, and entrepreneurial thinking to build resilient citizens.

Source in India, Build in India: For “Make in India” to succeed, sourcing must be domestic. Only then will local supply chains flourish.

Cultural Transformation: Shift the narrative from “job-seekers” to “job-creators.” “Wealth creation should be celebrated, not stigmatised.”

Read, Reflect, and Rethink

Read: Against All Odds: The IT Services of India – a must-read to understand how IT became our lifeline. But the past is not the future.

Reflect: Missing the Industrial Revolution cost India two centuries of growth. “Missing the AI revolution could cost us our future prosperity.”

Rethink: Every policymaker, entrepreneur, and parent needs to ask: “Are we preparing for yesterday or tomorrow?”

My 2 Cents:

India’s IT miracle was the story of the last generation. The next story is unwritten, and the pen is in our hands. We can reinvent—by fostering entrepreneurs, pivoting to products, and embracing AI—or we can stagnate, watching our greatest economic engine grind to a halt. The echoes of 2008 remind us how quickly things can collapse.

This time, we may not have the cushion of global bailouts.

👉 The question isn’t whether IT will slow—it already has. The real question: will India rise with new engines of growth, or will we become the cautionary tale of the 21st century?

Until next time,

Beyond the Ticker.

✉️ Enjoyed this? Hit subscribe for more clear, no-fluff breakdowns

📩 Want this in PDF or with segment-wise visuals next time? Let me know.

📬 Like this post? Drop your thoughts in the comments! 💬📢💡

If you found this useful and enjoyed this newsletter, don’t forget to

Subscribe for weekly insights, and share them with a fellow market nerd.

This was such a brilliant read!