India’s GPU Gladiator: How E2E Networks is Betting Big on AI Cloud Supremacy

From startup challenger to sovereign AI cloud backbone—E2E’s trillion-dollar chase in the GenAI gold rush.

Karan’s Substack | 14th Sep 2025 | Issue: 31

Dear Readers,

In this week’s newsletter, while scanning through a bunch of sectors for my subsequent Research, when I first looked at E2E Networks, I thought it was just another cloud infrastructure play trying to chip away at AWS and Azure. But then a single slide in their investor deck stopped me:

👉 The Delhi & Chennai facilities alone have the capacity to house 2048 GPUs.

That’s not “me-too into cloud Company.” That’s E2E quietly preparing its own GPU fortress in the age of GenAI.

Who are they?

E2E Networks Limited is not just another cloud services provider—it’s India’s first listed AI-first GPU cloud hyperscaler, listed on NSE since 2018 (main board from 2022). Headquartered in New Delhi, the company has quietly positioned itself as the homegrown alternative to AWS, Azure, and GCP—but with a laser focus on AI/ML and GenAI workloads.

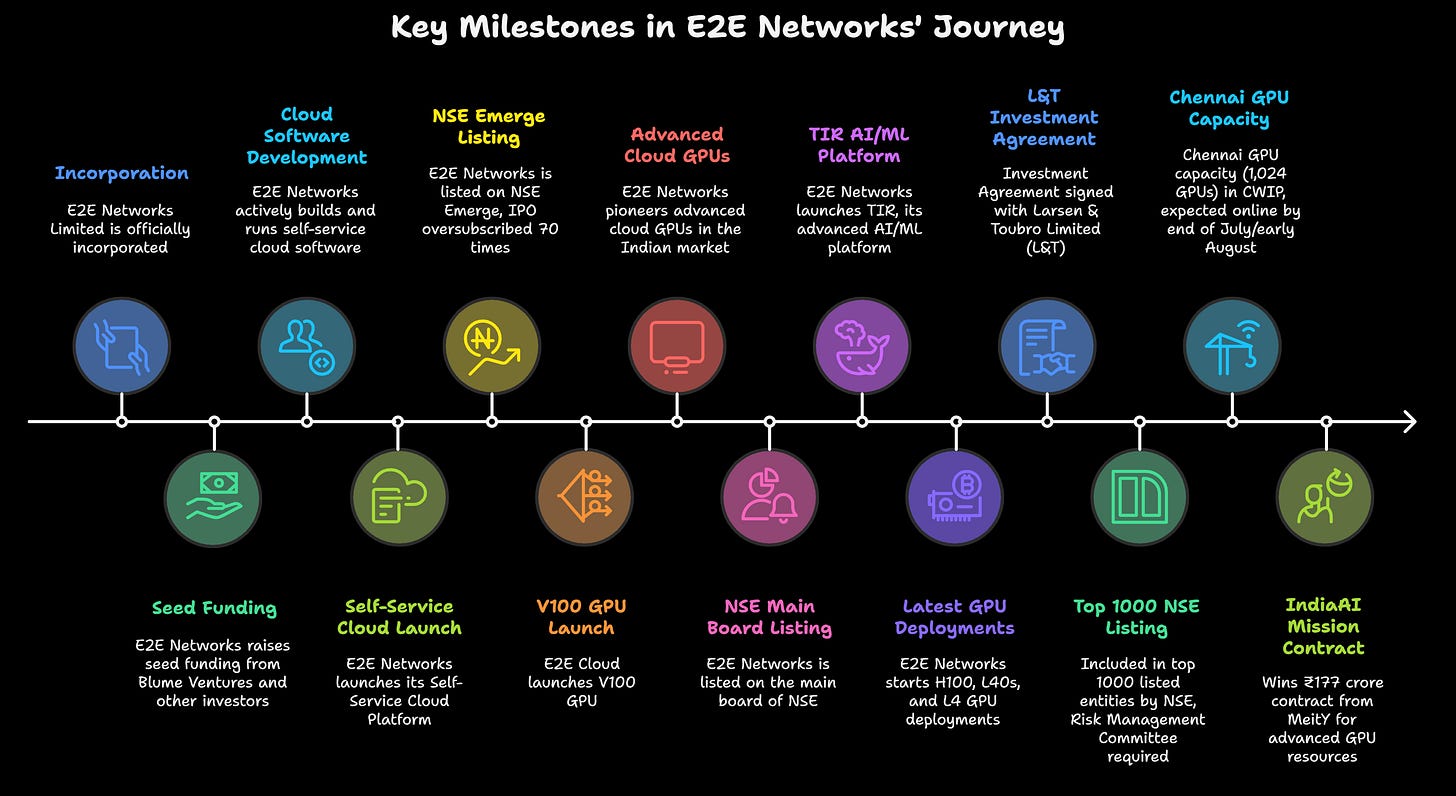

Origins: Founded in 2009 by Tarun Dua (ex-Yahoo, GlobalLogic) and co-founder Srishti Baweja (ex-PPAC, PwC), E2E started small, targeting enterprises with cost-efficient hosting solutions. But by 2019, it pivoted early into cloud GPUs, spotting the oncoming AI revolution.

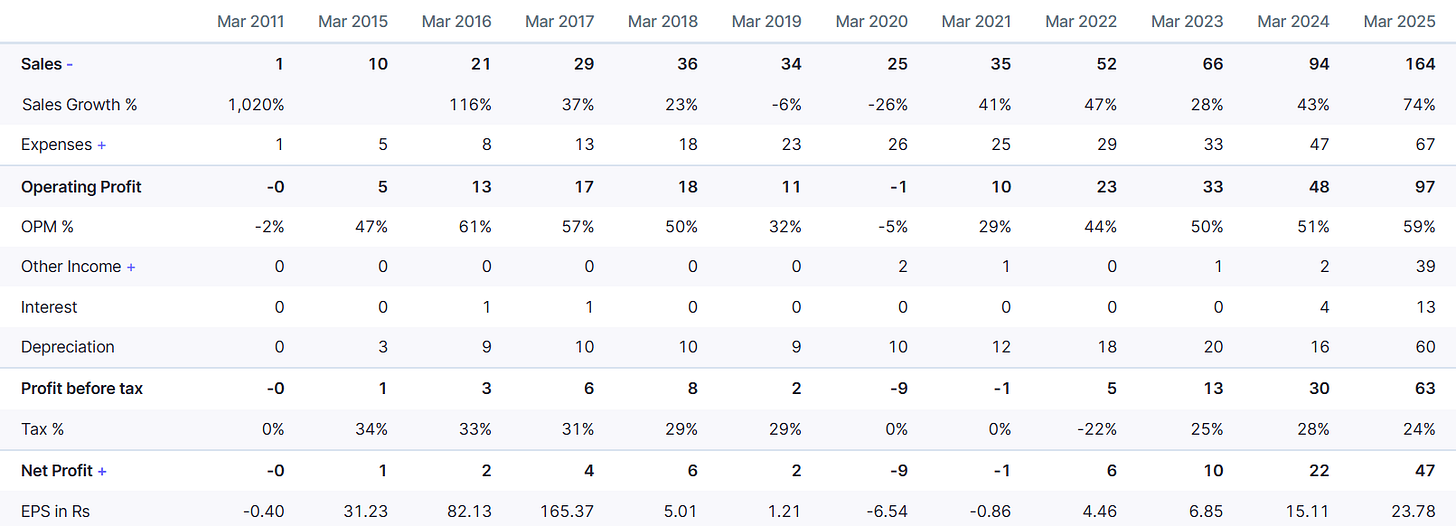

IPO & Growth: Its 2018 IPO on NSE Emerge was oversubscribed 70x—a rare feat for an infra company. By FY25, it had grown into a ₹164 Cr revenue firm (+74% YoY) with 59% EBITDA margins.

Identity Today: E2E is now a GPU-first hyperscaler with nearly 3,900 GPUs online, expanding aggressively into new data centers at Noida and Chennai, with the potential to scale to 20,000 GPUs at Chennai alone.

Their proposition is simple but powerful: Affordable, sovereign, high-performance AI cloud infrastructure for India’s AI-first economy.

So how do they make money (and where)?

E2E runs a GPU-first cloud platform, offering:

🔹 Cloud GPUs

The jewel in E2E’s crown—GPU clusters ranging from NVIDIA A100, H100, H200 to legacy A30/A40/V100/T4.

Current capacity: ~3,900 GPUs, including 700+ H100s and 2,300+ H200s.

Scale: Clusters up to 1,024 GPUs interconnected via Infiniband for large language model (LLM) training.

Use cases: Generative AI startups, SaaS firms embedding AI, higher education & research labs, government AI projects.

🔹 Linux Cloud

A cost-effective, high-performance compute layer for CPU-intensive tasks—memory-heavy workloads, smart dedicated compute, and enterprise Linux servers.

Complements GPU-heavy tasks by handling preprocessing, orchestration, and application workloads.

Competitive differentiation: Pricing and performance tuned for Indian developers/startups.

🔹 Infiniband (up to 3.2 Tbps)

The secret sauce behind E2E’s large GPU clusters.

Low-latency interconnects allow clusters to scale beyond a single server.

Key enabler for distributed training of LLMs and high-throughput HPC workloads.

A feature that even global hyperscalers sometimes restrict—E2E makes it available locally, reducing costs for Indian AI firms.

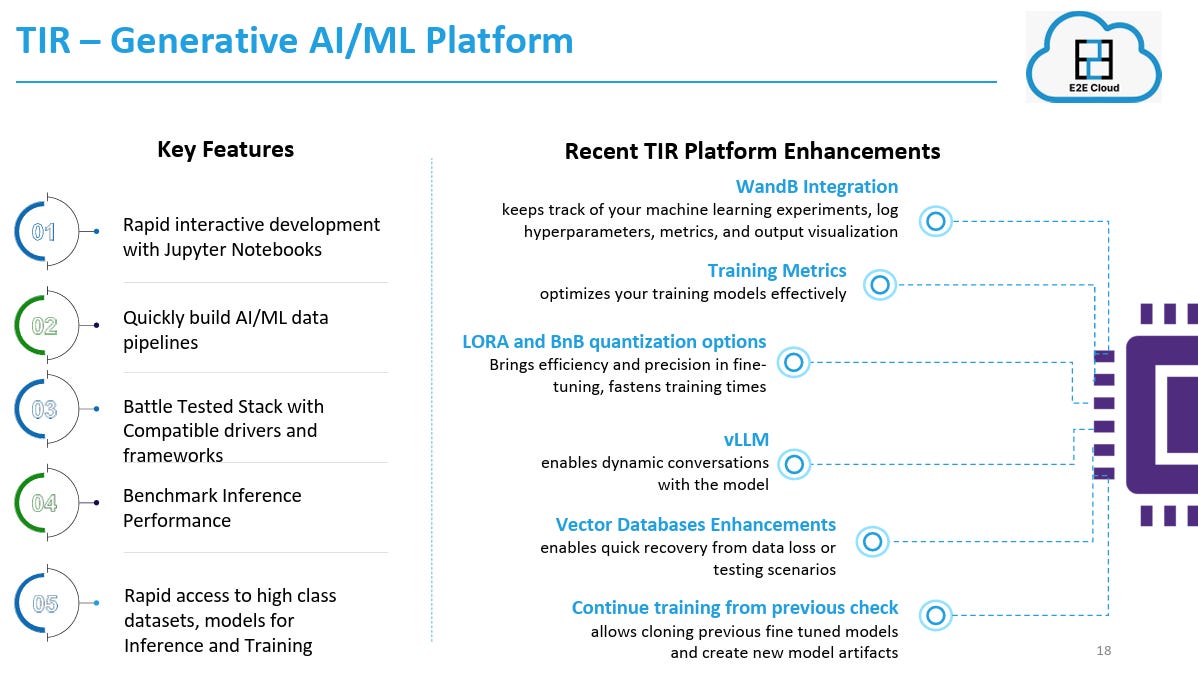

🔹 TIR – GenAI Platform

Launched in 2023, TIR is E2E’s flagship AI/ML development environment. Think of it as the “toolkit” for GenAI builders.

Components: Training clusters, inference engines, pipelines, RAG (retrieval augmented generation), Foundation Studio (fine-tuning with LoRA, DreamBooth), vector databases, and integrations.

Why it matters: Customers don’t just want infra; they want a ready-to-use AI dev stack. TIR bridges this gap.

🔹 Storage & Serverless

Storage: Block storage, object storage, container-attached storage, and elastic file systems.

Compute Abstraction: Kubernetes-based containers + OpenFaaS serverless compute for scaling microservices and AI applications without worrying about infra.

🔹 AI Labs as a Service (AILaaS)

Perhaps E2E’s most unique product is designed for universities and higher education institutions.

Provides pre-configured AI labs where professors can host lectures, projects, and assessments directly on GPU-backed infra.

Resource sharing: One GPU can support 15+ students simultaneously.

Dashboarding: Professors track usage in real time; private clusters ensure isolation.

This ties E2E to the talent pipeline of India’s AI ecosystem—long-term brand play.

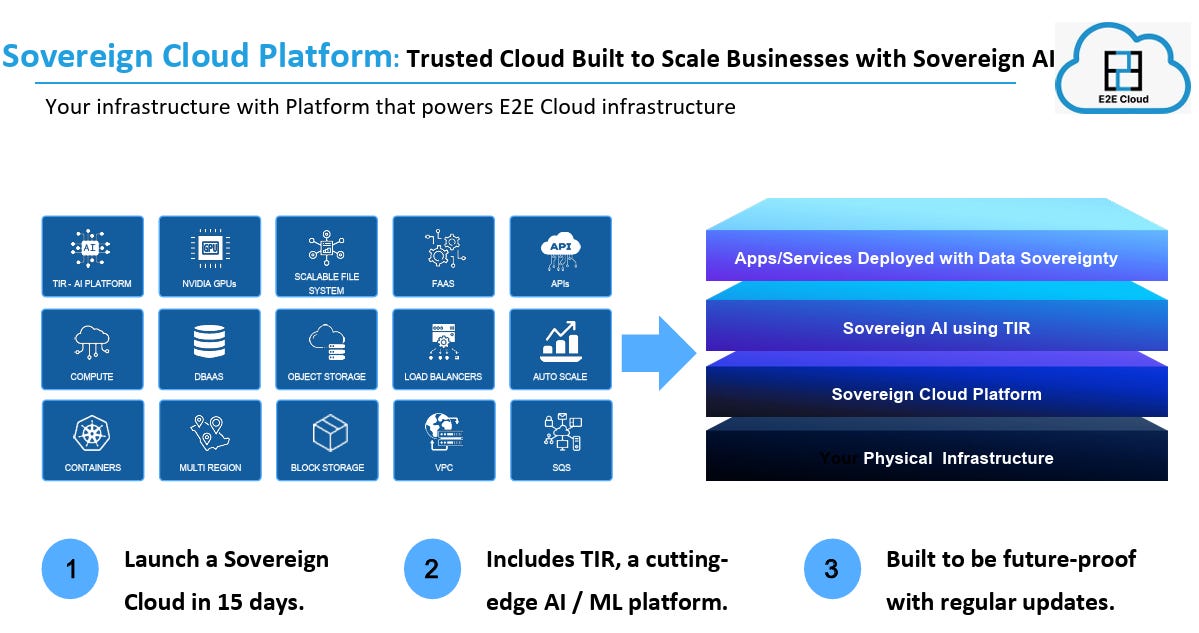

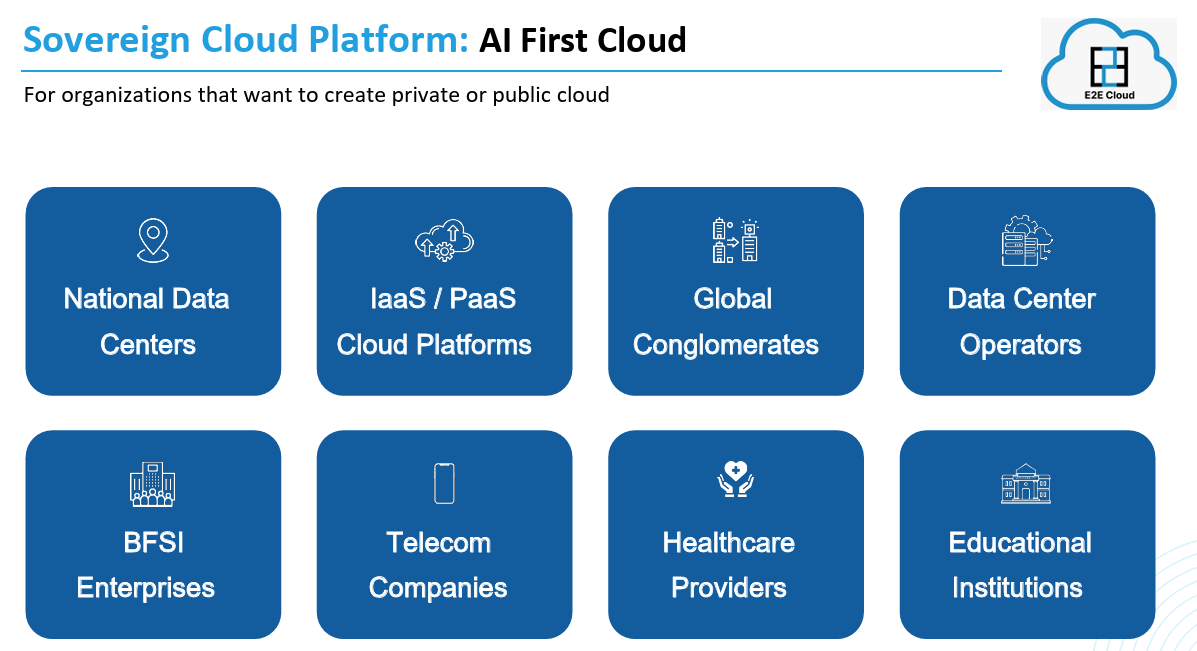

🔹 Sovereign Cloud Platform

E2E’s differentiation from global hyperscalers.

A full-stack sovereign platform with 50+ IaaS and PaaS services—giving enterprises total control over data, stack, and compliance.

Ideal for regulated sectors (BFSI, Govt, PSUs, defence) where data sovereignty is non-negotiable.

E2E Positioned as India’s answer to AWS GovCloud.

Journey so far:

Zooming Out! 10,000 Ft. View

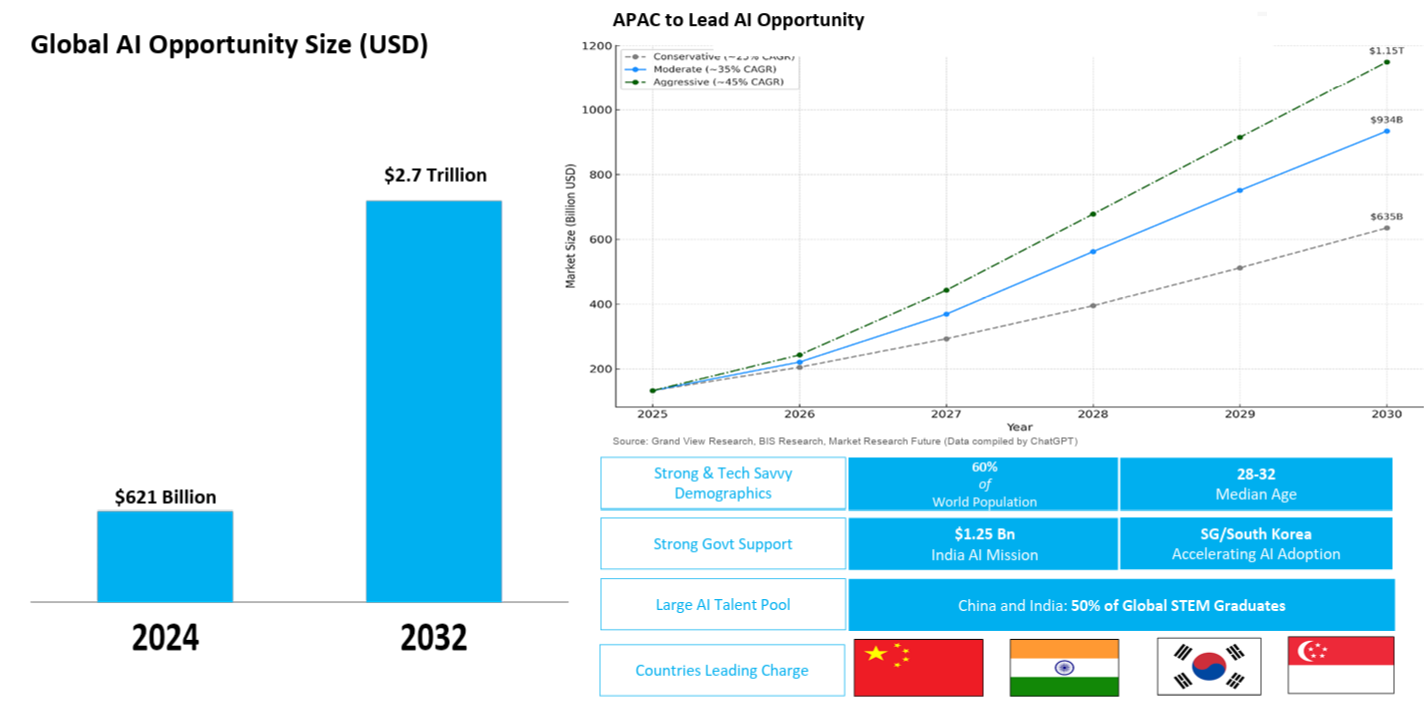

India AI Cloud TAM: Public cloud market expected to hit $30.4B by 2029 (IDC).

AI Compute Race: Global AI infra market = $62.1B → $2.7T by 2032.

Edge for E2E: Unlike hyperscalers, they push cost-efficient, India-first sovereign cloud with deep local compliance.

Global vs Local: While AWS/Azure chase global AI SaaS workloads, E2E positions itself as India’s trusted infra backbone—aligned with the govt’s IndiaAI Mission.

Numbers That Matter

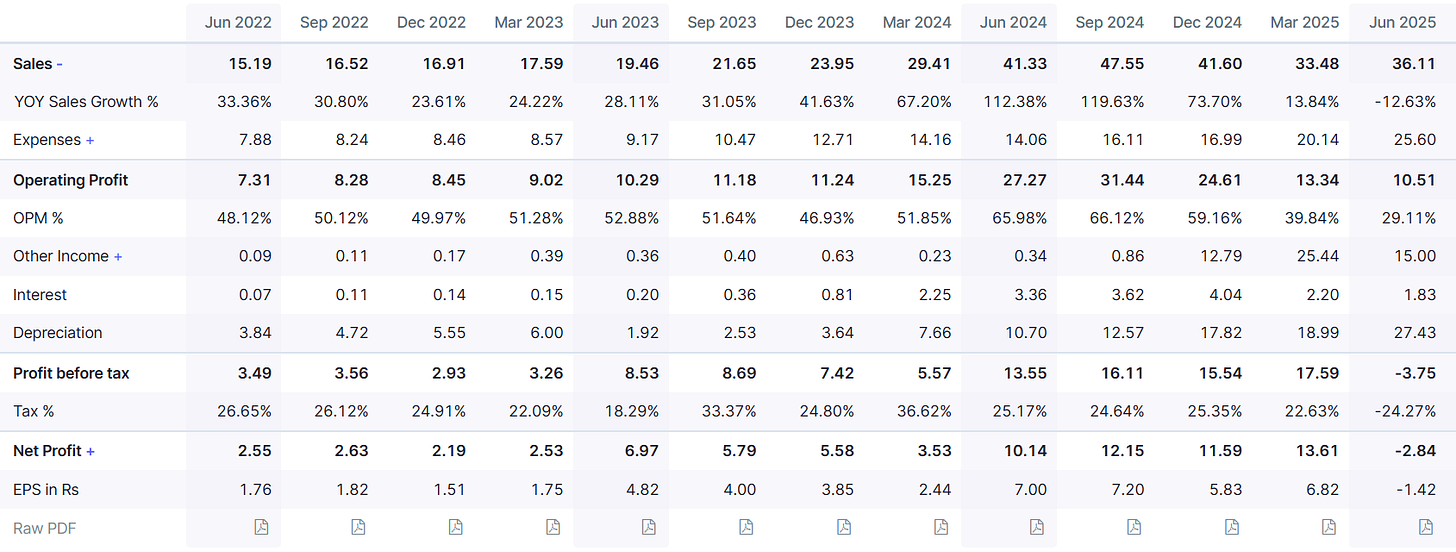

Why Such Horror Show in Q1 FY26?

Delayed Chennai Facility:

Revenue growth was hampered due to technical complications in launching the new Chennai data center, which deferred planned capacity expansion and delayed income realization.

Low GPU Utilization:

Despite significant investments and installation of nearly 3,900 GPUs, actual usage remained at 50-60%, leading to inefficient monetization of these assets.

Lag in New Revenue Streams:

Plans for scaling up software licensing revenues have not yet been successful; rollout delays and slower customer onboarding contributed to lower top-line growth.

Upfront Capex Costs:

The company faced high upfront operating costs related to new facilities and hardware deployments, which impacted margins, especially when coupled with tepid revenue.

Q1 FY26 was a one-off Blip:

Revenue: ₹36.11 Cr, (down -12.63% YoY & up 7.86% QoQ)

EBITDA: ₹10.51 Cr (-61.5% YoY); margins shrunk from 65.98% → 29.11%.

PAT: Loss of ₹2.84 Cr (down -128% YoY & -120.90% QoQ)

EPS: -₹1.42 Rs. (down -120.30% YoY & -117.5% QoQ)

FY25 (full year):

Revenue: ₹164 Cr (YoY +73.6%).

PAT: ₹47 Cr. (YoY +117.2%).

EBITDA Margin: 59%.

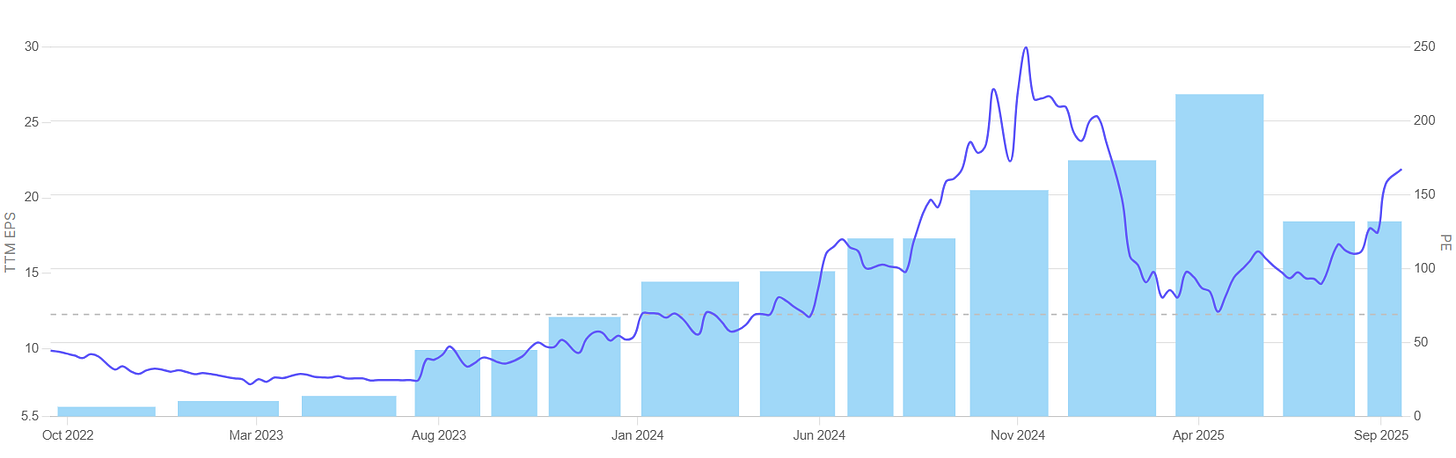

EPS: 23.78 Rs. (YoY +87.2%).

But hidden in plain sight:

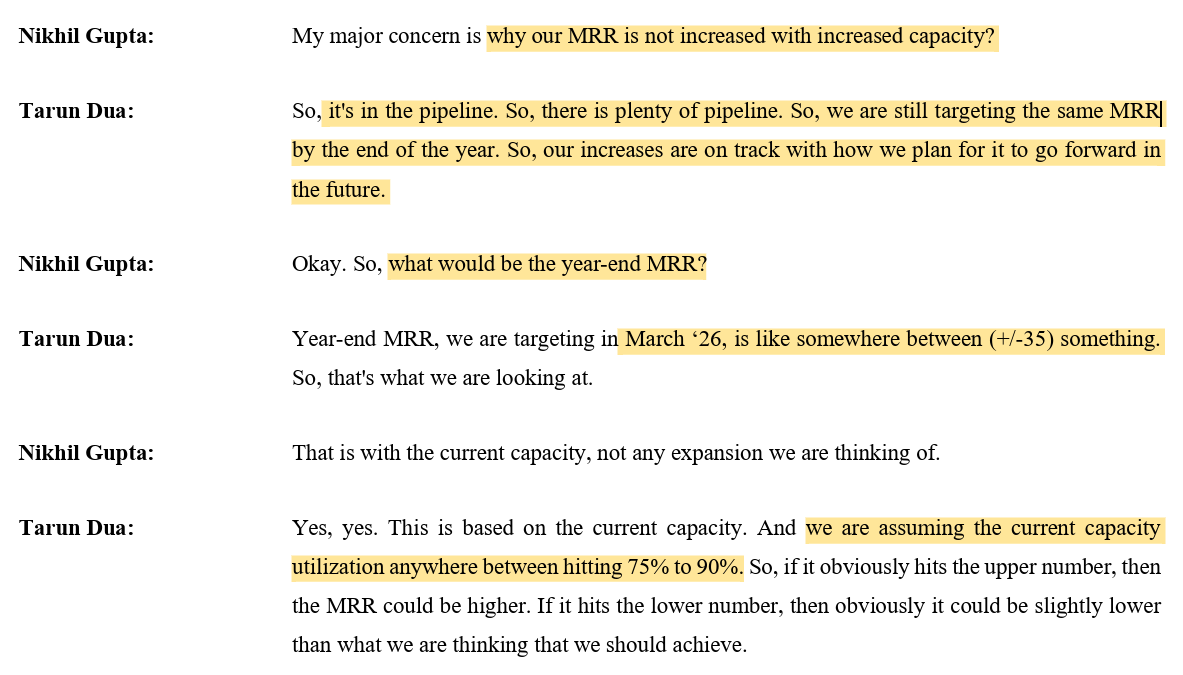

MRR jumped to ₹14.5 Cr in June ’25 (vs. ₹11.2 Cr in Mar ’25).

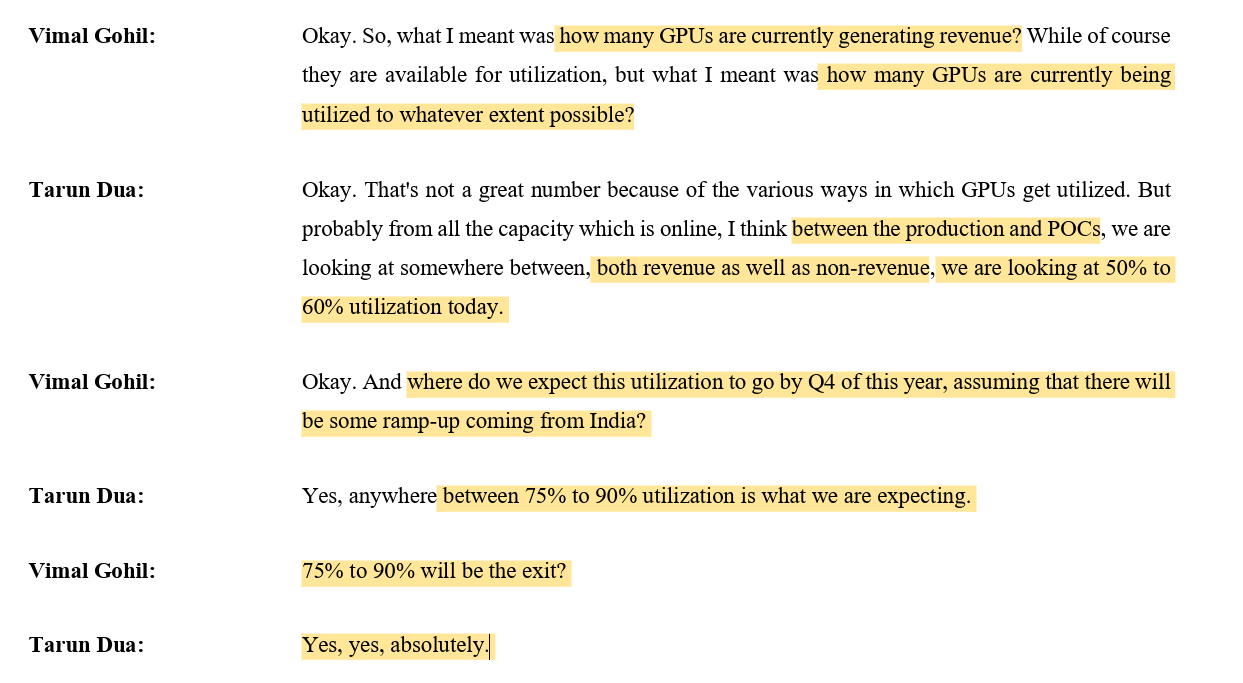

GPU utilization: 50–60% now → mgmt targets 75–90% by Q4.

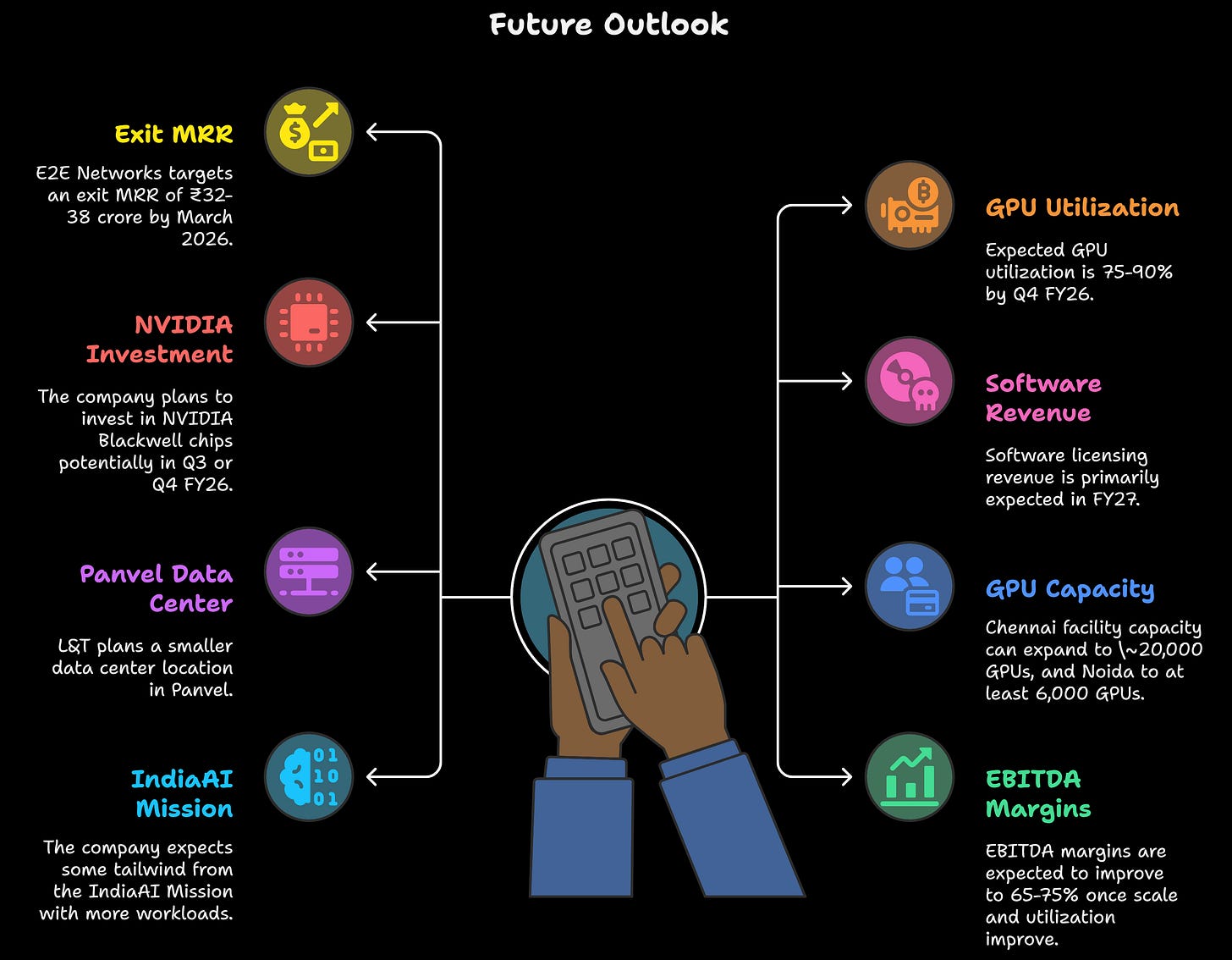

Exit MRR FY26: ₹32–38 Cr guided.

What am I excited about?

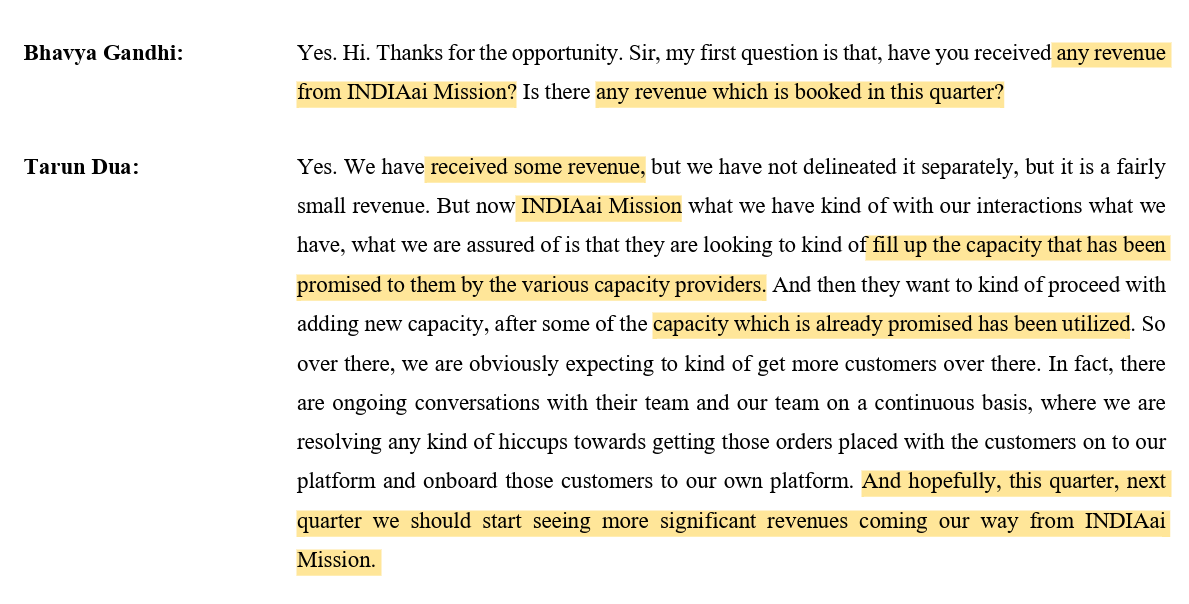

IndiaAI Mission win: ₹177 Cr MeitY contract for H100/H200 GPUs to GNANI AI on September 1, 2025, to supply advanced GPU resources (H100 SXM and H200 SXM GPUs to GNANI AI) for the IndiaAI Mission.

This is expected to materially impact upcoming quarters. While the mission might lead to some margin contraction, management does not expect it to significantly impact overall company margins, seeing it as a contribution to a national mission.

Acquisition: Jarvis Labs AI IP, infra & customers—boosting AI-native software stack. The company's board approved the acquisition of specific AI/ML assets from Jarvis Labs AI Pvt Ltd, including intellectual property, hardware, domain, and customer assets, which is expected to strengthen E2E's AI/cloud capabilities and open new market opportunities.

L&T stake: ₹1,079 Cr infusion; L&T is using E2E for digital transformation workloads. E2E is partnering with L&T on digital transformation initiatives by providing AI-optimized GPU infrastructure and high-performance computing. Management is focused on leveraging synergies and expanding business within the L&T ecosystem.

NVIDIA Partner: First mover on H100/H200 in India; priority access to Blackwell GPUs (B200/B300).

What Management Thinks (and Plans)

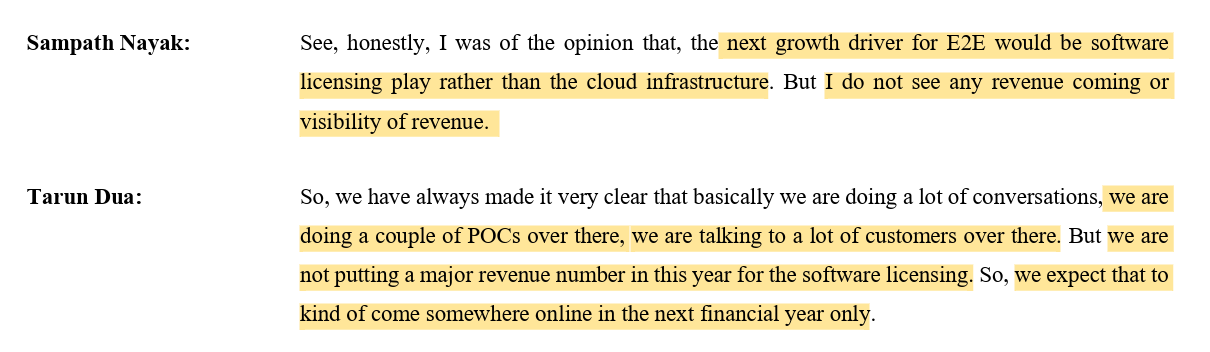

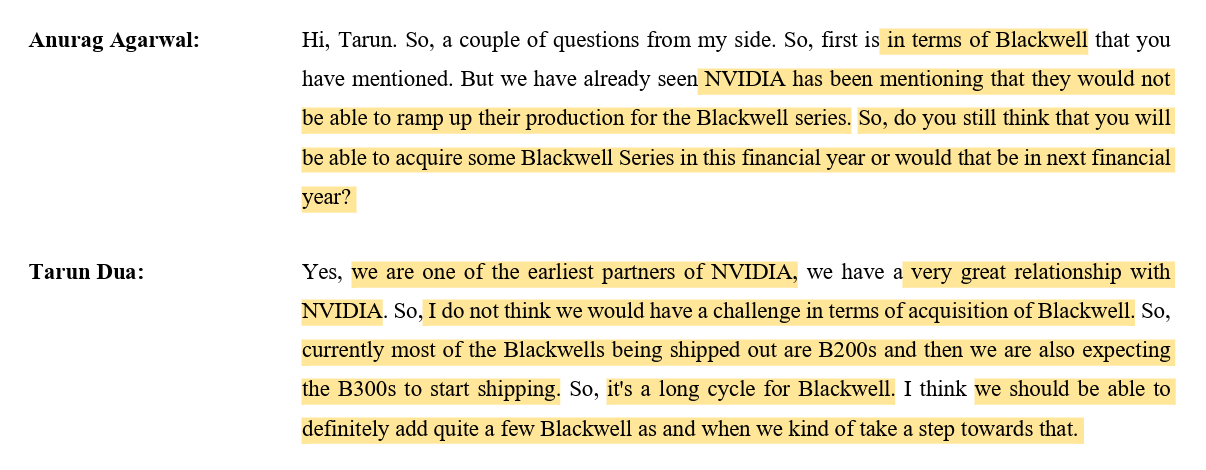

From Q1 FY26 concall:

Cautiously optimistic on IndiaAI Mission revenue ramp.

Defensive yet confident about Chennai delays.

Patient on software licensing—“next year only.”

Highly confident in NVIDIA supply chain (Blackwell assured).

Aggressive on utilization ramp (75–90% by Q4).

The Big Money Plans – Capex & Fundraising

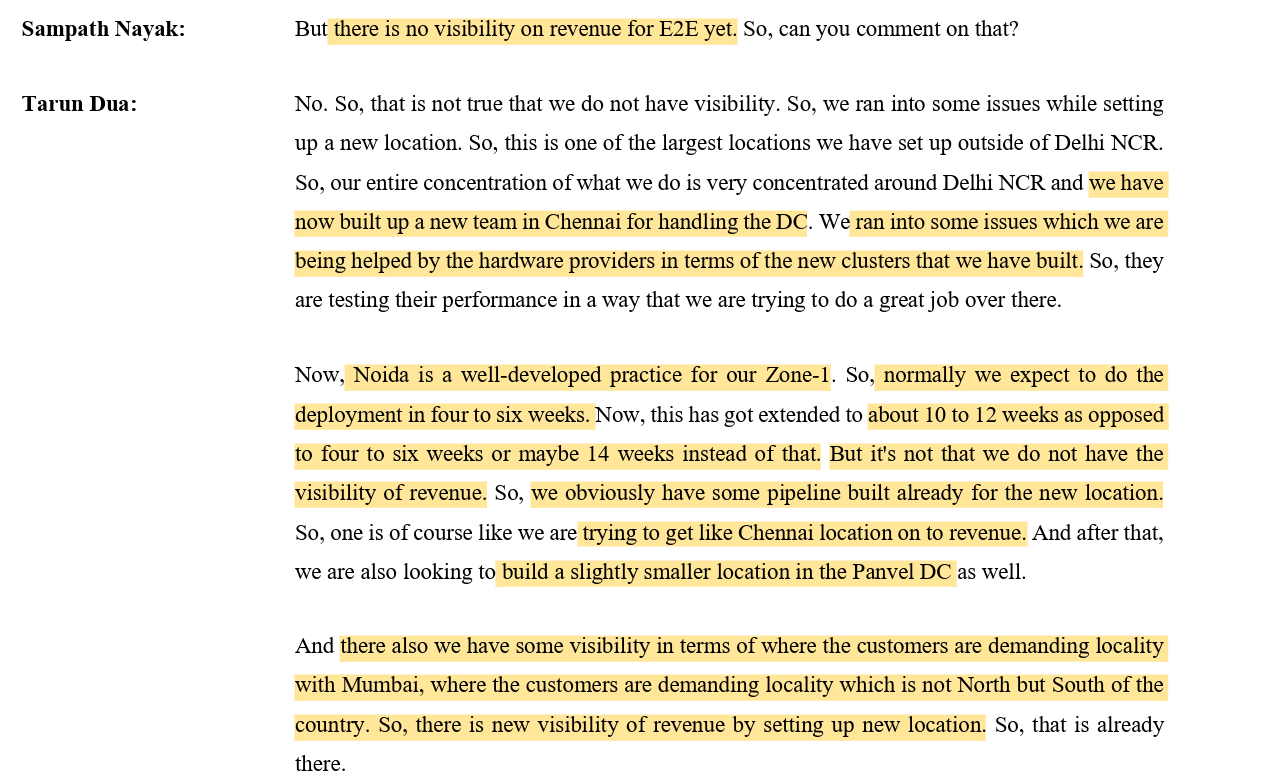

Q1 FY26 CAPEX: ₹1,853m spent; ₹3,109m CWIP (Noida live, Chennai pending).

Funds: ₹8,842m preferential used; ₹3,839m balance left.

Expansion Potential: The Chennai site alone is expandable to 20,000 GPUs.

That’s management going “all-in” on AI infra.

Risks & Valuations

Risks:

Delays (Chennai rollout already hit timelines).

Margin squeeze if the government contracts ramp too fast.

Dependence on the NVIDIA supply chain.

Software monetization pushed out to FY27.

My Valuation Lens: With FY25 revenue at ₹1,640 Cr (+74% YoY) and FY26 exit MRR guided at ₹32–38 Cr, the market will price execution over promises. The Q1 miss shows expectations vs delivery is the gap to watch.

Con-Call Goldmine

Management is cautiously optimistic and hopeful, acknowledging the current modest contribution but expressing strong confidence in future growth from the government initiative.

Management looked to me Defensive yet confident about future revenue from L&T, they were transparent about operational delays, and prudent/realistic about E2E's specific role within the larger L&T ecosystem. Delays are technical, not demand-side.

Management is Realistic and patient with software licensing, reiterated that software licensing is in "early days" with conversations and Proof-of-Concepts.

Management is transparent about the current underutilization of GPUs, but confident and optimistic about achieving significantly higher utilization by year-end.

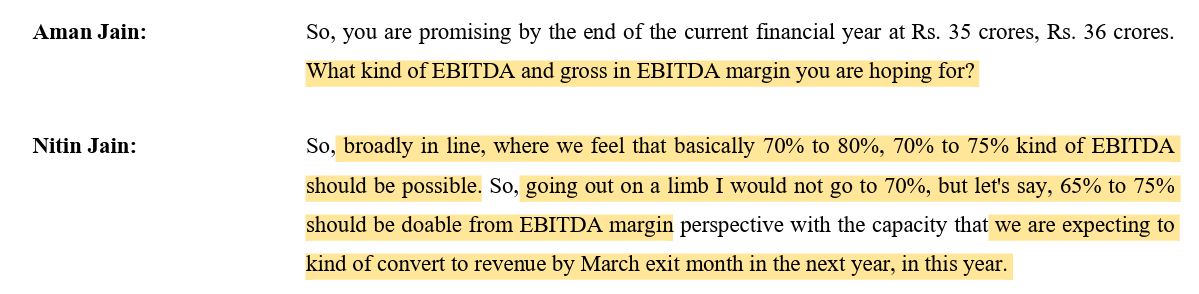

EBITDA Margins Target: 65–75% achievable once utilization scales. Management is Confident and specific, providing a clear margin range with a slightly conservative nuance, indicating high margin expectations as revenue scales.

NVIDIA Supply Risk: “We’re their earliest partners, Blackwell won’t be an issue.” Management looks highly confident about securing cutting-edge NVIDIA technology due to a strong partnership, and strategic/flexible about exploring other vendors based on market demand.

Words that Matter

“We are very, very confident of the pipeline.” – Tarun Dua, MD

“65–75% EBITDA should be doable.” – Management on margin recovery

“It’s not just capital, it’s a vote of confidence.” – Annual Report on L&T’s stake

The Competitive Arena

Global Hyperscalers (AWS, Azure, GCP): Bigger scale, but expensive + less India-specific compliance.

Yotta, NTT, CtrlS (local DCs): Infra-rich but not GPU/AI-first.

E2E’s Moat: First-mover in GPU hyperscale cloud in India, sovereign narrative, NVIDIA Blackwell pipeline, L&T backing.

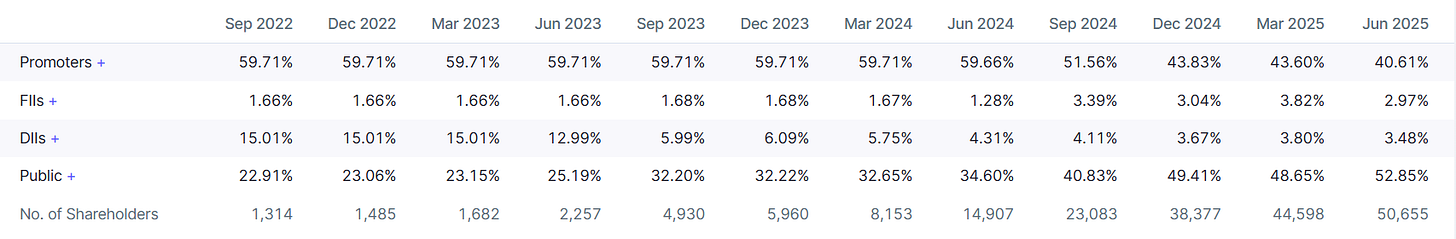

The Investor Sentiment Shift:

Promoters, FII and DII have reduced their Stake Slightly in the Company this quarter.

Once backed by Blume Ventures and Currently Backed by Bandhan MF and Larsen and Toubro (18.99%)

Technical Setup: (Bonus: If you came this far reading)

My Technical Take:

Price Action Analysis:

• Stock has formed a massive symmetrical triangle/wedge pattern

• Recent breakout above the upper trendline resistance around 2,900-3,000 levels

• Currently trading at 3,084.10 with strong momentum and above-average volume

• Price action shows a clear shift from consolidation to the trending phase

• Multiple higher lows formation during the consolidation phase indicates underlying strength

Volume Spread Analysis:

• Volume spike visible during the recent breakout, confirming genuine buying interest

• Volume at 813.46K vs average volume of 422.91K, indicating a 92% increase

• Consistent volume support during the base formation phase

• Volume-price confirmation suggests institutional participation

Key Technical Levels:

Support Levels:

• Primary Support: 2,700-2,800 (previous resistance turned support)

• Secondary Support: 2,400-2,500 (triangle breakout level)

• Major Support: 2,000-2,100 (psychological level and previous consolidation zone)

Resistance Levels:

• Immediate Resistance: 3,200-3,300 (next psychological level)

• Major Resistance: 3,500-3,600 (measured move target from triangle)

• All-time High: 5,487.65

Link to the Full Idea:

https://in.tradingview.com/chart/E2E/sZjgjgiQ-E2E-Base-Formation-and-Trend-Change-Chart-of-the-Week/

My 2 Cents:

E2E Networks is no longer a challenger cloud—it’s morphing into India’s sovereign GPU powerhouse. FY25 was blockbuster (74% revenue growth), but FY26 began with stumbles (Q1 loss, Chennai delays).

The story is intact, but execution is king.

⭐ What I’ll Track Next:

Chennai 1,024 GPUs going live (Aug ’25).

MRR trajectory toward ₹32–38 Cr exit run-rate.

First visible IndiaAI Mission billing impact.

Any signs of FY27 software licensing monetization?

This Week’s Recommendation:

Think School Explains Nvidia transformed from near bankruptcy to a $4 trillion powerhouse by embracing failure, innovating with chips, and pioneering AI technology through CUDA, which enabled breakthroughs in machine learning and graphics processing.

Two key lessons for me:

1. Play the long game by building for the future, not just the present.

2. Have conviction, stay patient, and keep at it even when others don’t see it yet.

Disclaimer:

As per the Latest SEBI Mandate, this isn't a Trading/Investment RECOMMENDATION nor for Educational Purposes; it is just for Informational purposes only. The chart data used is 3 Months old, as Showing Live Chart Data is not allowed according to the New SEBI Mandate.

I am not a “SEBI-registered research Analyst and Investment Adviser”

This analysis is intended solely for informational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor and conduct thorough research before making any investment decisions.

✉️ Enjoyed this? Please Hit Like and Restack. Hit subscribe for more clear, no-fluff breakdowns of India's hidden gems and high-growth bets.

📩 Want this in PDF or with segment-wise visuals next time? Let me know.

📬 Like this post? Drop your thoughts in the comments! 💬📢💡

If you found this useful and enjoyed this newsletter, don’t forget to

Subscribe for weekly insights, and share them with a fellow market nerd.

very nicely put , on not a directly related but important part of AI/ data center theme , can you try to cover Shree refrigeration for cooling side of this hot sector

Need your write up on moschip vs asm technologies, amazing write up on AMS,in no time it becomes 3bagger from 125 rp around a year back,do you still feel ,it is long story