Prostarm Info Systems: Batteries & Billion-Dollar Bets

Cracking the BESS Boom & Discovering a Hidden Contender Will Prostarm Be the Dark Horse of the Battery Boom?

Karan’s Substack | 12th July 2025 | Issue: 22

So this week, while scanning through a bunch of sectors for my next research rabbit hole, I stumbled upon something that’s quietly powering the world’s clean energy dreams: Battery Energy Storage Systems (BESS). What started off as a curiosity turned into hours of reading reports from BoFA, SBICAPS, and an interesting Indian company’s annual report — Prostarm Info Systems Ltd. I went deep into the global BESS boom and tried to understand where value is being created, who’s capturing it, and whether a small but strategic player like Prostarm could ride this energy storage wave. Here’s everything I uncovered.

The Rising Importance of Energy Storage:

As the world races to decarbonize its economies and tackle the climate crisis, energy storage has emerged as one of the most critical technologies of this decade. It has gone from being a backup measure to becoming a foundational layer of future power infrastructure. The need to store energy—especially intermittent solar and wind power—has made Battery Energy Storage Systems (BESS) essential for countries striving to maintain both sustainability and energy security.

Without effective storage, clean energy becomes unreliable, prone to waste, and incapable of meeting peak demand. But with BESS, renewable energy becomes firm, dispatchable, and scalable.

Countries such as the US, China, and Germany have integrated storage deeply into their national energy plans. India, too, has begun recognizing the vital role of BESS. The International Energy Agency (IEA) projects over 600 GW of storage needed globally by 2030 (Source: IEA Energy Storage Report 2023)—a 15x increase from current levels. India alone will need to support 500 GW of non-fossil fuel power with responsive storage solutions (Source: Ministry of Power, India).

"Energy storage is not just a technical need — it’s a strategic asset."

Energy storage also plays a big role in decentralizing power systems. Microgrids, rural electrification, EV charging infrastructure, and industrial load management all hinge on scalable and flexible battery storage.

Sector Deep Dive: The Battery Energy Storage Boom

Battery Energy Storage Systems are central to global clean energy transformations. They ensure that the surge of renewable energy supply—especially solar during the day—is not lost and is instead stored to meet demand during evening and night peaks.

BESS helps in:

Smoothing energy delivery from fluctuating renewable sources.

Reducing dependence on fossil fuel peaker plants.

Stabilizing transmission infrastructure, reducing the need for costly upgrades.

Providing backup power to mission-critical sectors such as hospitals, data centers, and industrial plants.

"BESS isn’t just a backup — it’s the glue holding the renewable revolution together."

As new battery chemistries like Sodium-ion, Zinc-air, and Solid-State batteries gain traction, the BESS market is no longer just about Lithium. Moreover, energy storage is now part of climate adaptation and disaster preparedness policies in several countries.

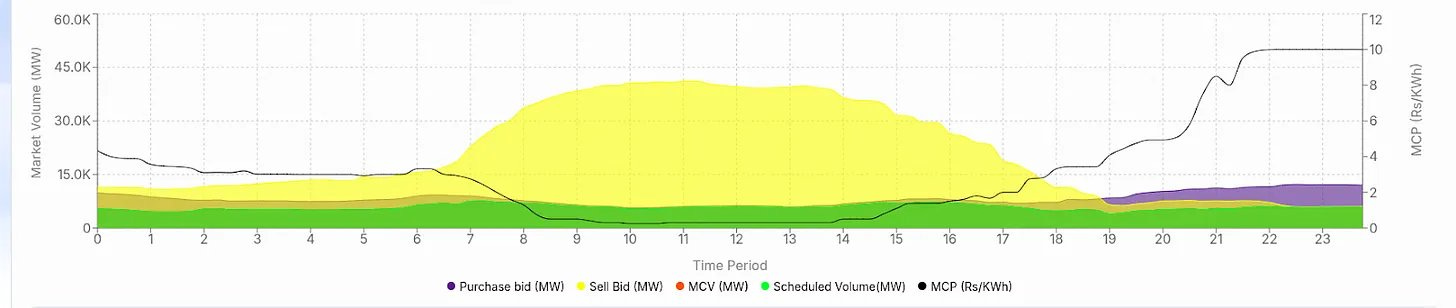

The ability of BESS to engage in time-of-use arbitrage (buying power when cheap, selling when expensive), grid frequency regulation, and fast-ramping services makes it indispensable. Coupled with advances in AI-driven energy management and predictive analytics, BESS is no longer passive—it is becoming a dynamic grid participant.

Following major grid failures in regions like Texas (2021), South Australia (2016), and even in Maharashtra, India (2020), battery storage has been termed as “insurance for power reliability.”

📊 Global Projections:

"Battery energy storage systems (BESSs) are becoming more and more crucial in modern smart grids as the global energy transition speeds up." — Moxa

Global BESS installations could grow to 520–700 GWh by 2030

(Source: BloombergNEF 2024)

India is expected to expand its BESS capacity from <2 GW to 42 GW by FY32, a 12x jump (Source: SBICAPS/MINT)

The global investment outlook for BESS exceeds $150 billion, while India’s market alone could absorb ₹3.5 trillion by 2032

(Sources: McKinsey & NITI Aayog)

🔋 Dominant Technologies:

Lithium-ion (LFP & NMC) dominates, but alternatives are gaining traction.

New entrants like Sodium-ion, Solid-State, and Flow batteries are emerging.

Costs have fallen drastically—a 40% drop in 2024 alone, with projections for another 40–54% drop by 2035. (Source: BloombergNEF 2024)

"As costs fall and incentives rise, the barriers to mass-scale adoption are quickly disappearing."

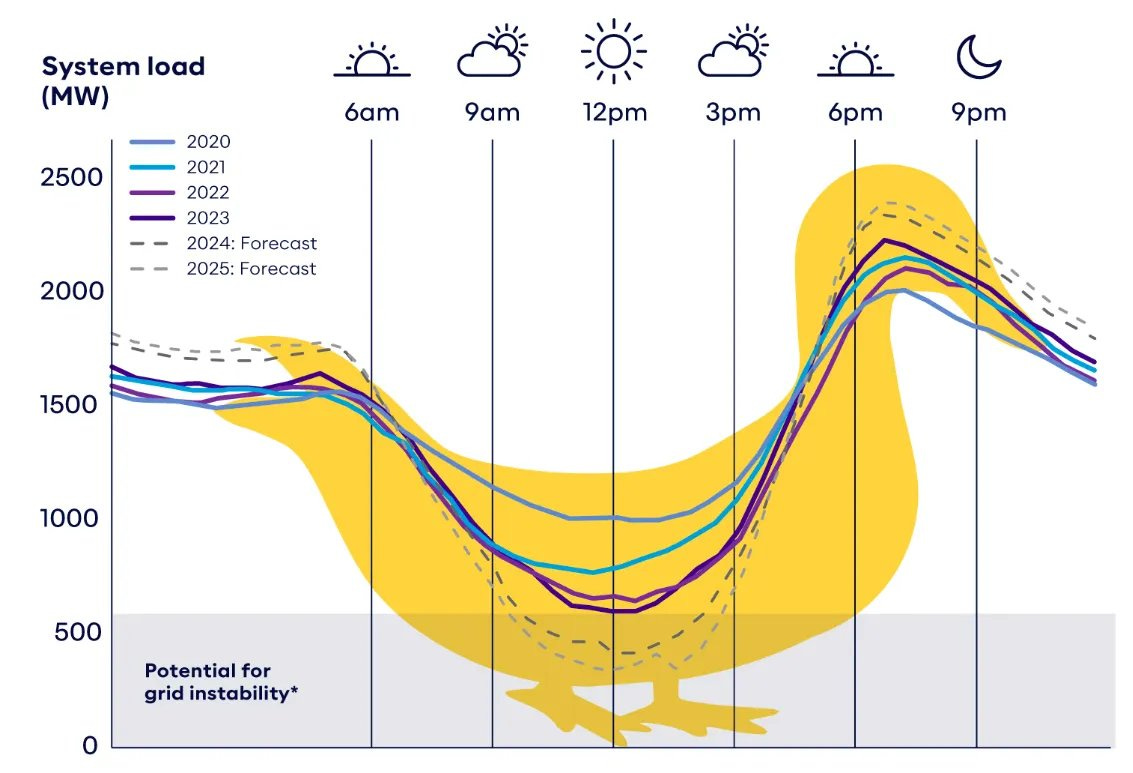

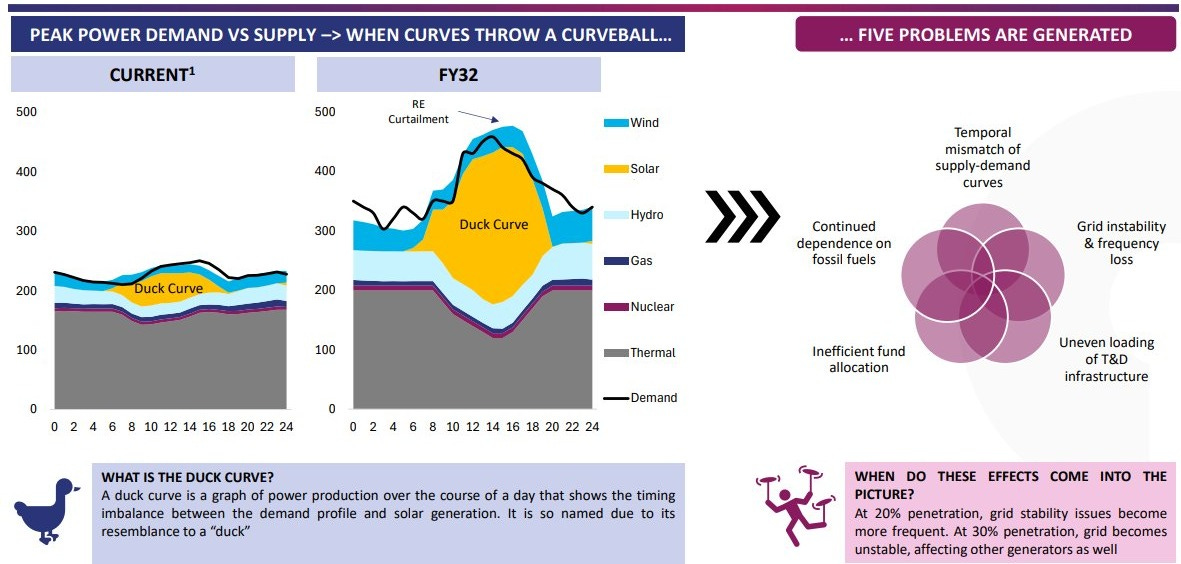

🔍 Understanding the 'Duck Curve':

The 'Duck Curve' visualises how solar generation causes a steep ramp in evening grid demand. This daily mismatch causes voltage instability, power quality issues, and underutilization of solar capacity.

When the sun blazes at midday, solar panels crank out massive amounts of electricity - enough to power entire states. But people don't need the most electricity when the sun is strongest. They need it in the evening when everyone comes home.

This creates the "duck curve" - a graph that looks like a duck's back. Electricity demand dips during sunny midday hours as solar takes over, then ramps up steeply in the evening when solar fades and lights, ACs, and TVs turn on across the country.

So the more solar Power we add without storage, the steeper and more dangerous the duck curve becomes.

🔧 Duck Curve Solutions:

BESS is central to managing this challenge. Solutions include:

Time-shifting solar to evening peaks

Frequency and voltage control via grid-scale batteries

Hybrid renewable-plus-storage projects

Behind-the-meter BESS for C&I customers

Virtual Power Plants (VPPs) that aggregate distributed batteries

"Storage is how we turn the duck into a dove — from volatility to stability."

India’s Tailwinds:

India is fast-tracking BESS adoption through:

"Energy storage has gone from an accessory to an absolute necessity in India's decarbonization roadmap."

Tenders with storage jumped from 5% in FY20 to 23% in FY24 (ISGF 2025). The policy ecosystem is maturing with regulators offering better visibility on tariffs, incentives, and system requirements.

⚖️ Cost Structure & Challenges:

"India imports nearly 100% of its lithium-ion cells, making local integration and system-level innovation the most viable path in the short term." — NITI Aayog

BESS cost breakdown:

50% battery cell cost

25% inverter, BMS & software

25% EPC and system integration

Challenges include raw material security, recycling regulations, and talent availability.

Prostarm Info Systems Ltd – A Hidden Contender?

In India’s BESS ecosystem, Prostarm is an emerging player positioning itself as a systems integrator and energy backup specialist for commercial and industrial (C&I) clients.

"They’re not manufacturing cells — they’re building the systems that make cells functional and grid-ready."

Their strength lies in their existing market share in mid-sized UPS systems, which are adjacent to BESS deployments. The company’s customer base spans BFSI, telecom, healthcare, and light manufacturing—all of which demand high uptime and stable power.

🧾 Quick Facts:

FY24 Revenue: ₹257.9 Cr | PAT: ₹23.95 Cr

EPS: ₹5.59 | Growth: 11.6% YoY topline

Zero dividend policy, high reinvestment

IPO raised ₹168 Cr

🧰 Offerings & Operations:

💰 Financial Depth:

Operating leverage is visible in margin expansion

Clean balance sheet; scale-ready

Strong regional distributor network

👨💼 Leadership & Governance:

Promoter: Tapan Ghose, >30 years of experience

ESG initiatives: ₹37L+ in CSR in FY24

🧭 Competitive Moat & Regulatory Advantage:

Prostarm sits in a rare position:

Not a battery manufacturer (no commodity risk)

Not a utility (no regulation overhead)

Focused on system integration, a high-margin segment

"The top 10 BESS players control 61% of global capacity — India’s market is still wide open." — BofA

Investment Angle:

Prostarm is an asymmetric play—moderate downside, high optionality. It benefits from:

BESS sector tailwinds

Post IPO visibility

Expanding the addressable market in Tier 2/3 cities

"If energy storage is the new digital infra, Prostarm might be an early systems architect."

Sector Outlook Wrap:

India’s BESS + PSP infrastructure will need ₹5 trillion+ by FY32. This includes:

41.7 GW/228.5 GWh battery storage (by 2030)

18 GW pumped hydro

New market mechanisms: capacity payments, storage PPAs

"The IEA estimates that battery deployment must increase six-fold by 2030 to keep climate goals within reach."

📚 References:

International Energy Agency (IEA) Energy Storage Report, 2023

Energy for Growth Hub: Emerging Market BESS Strategy (2023)

Bonus (if you came this far reading):

Thrilled to share that my latest TradingView post has been selected for Editor’s Picks and is now featured on https://in.tradingview.com/ideas/

Link to the Full Idea:

This Week’s Recommendation:

In this bold and wide-ranging conversation, investor and author Saurabh Mukherjea explains how artificial intelligence is triggering the biggest shift in India’s white-collar workforce in decades.

A must-watch for professionals, students, parents, and policymakers who care about India’s future.

Disclaimer:

“I am not a SEBI Registered Research Analyst and Investment Adviser”

This analysis is intended solely for informational and educational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor and conduct thorough research before making any investment decisions.

✉️ Enjoyed this? Hit subscribe for more clear, no-fluff breakdowns of India's hidden gems and high-growth bets.

📩 Want this in PDF or with segment-wise visuals next time? Let me know.

📬 Like this post? Drop your thoughts in the comments! 💬📢💡

If you found this useful and enjoyed this newsletter, don’t forget to

Subscribe for weekly insights, and share them with a fellow market nerd.