Vimta Labs: From Testing Tables to Billion-Dollar Biologics – The Silent Disruptor in India’s CRO Story

How a Hyderabad-based lab is quietly building India’s next global Contract Research powerhouse.

Karan’s Substack | 6th Sep 2025 | Issue: 30

Dear Readers,

In this week’s newsletter, while scanning through a bunch of sectors for my subsequent Research, when I first dug into Vimta Labs, I expected to find just another mid-cap testing company eking out steady margins.

But then one line in the Q1 FY26 call transcript stopped me cold:

“Commercialization of our biologics CRDMO facility begins Q1 FY27.”

That’s not just a new business line—it’s an entry ticket into a $653 billion global biologics market. For a company that built its reputation testing food, water, and pharma, this pivot could redefine its DNA.

The thought struck me: could this Hyderabad-based lab be quietly preparing to challenge the likes of Syngene or even global CRO/CDMO names?

Who They Are – Beyond Just a Company

Vimta Labs, headquartered in Hyderabad’s Genome Valley, is a Contract Research Organisation and Testing, Inspection, and Certification Organisation (CRO + TIC).

Its tagline says it all: “Driven by Quality. Inspired by Science.”

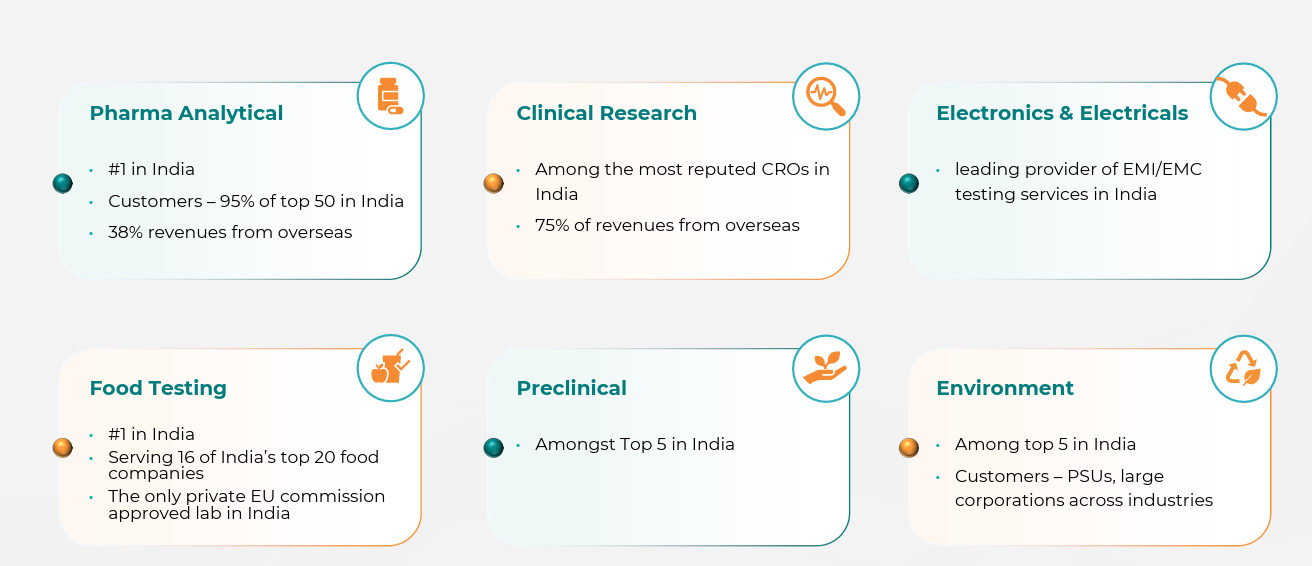

Core business: Pharmaceutical testing, analytical services, preclinical & clinical research, food & environment testing, and electrical/electronics compliance.

Vision: To be India’s most trusted lab partner across life sciences, food safety, and industrial testing.

Origin Story: Founded in 1984, Vimta started as one of India’s earliest private labs focused on scientific testing. Over four decades, it has grown from a single-site testing service into a diversified, multi-segment CRO with global accreditations from regulators like the US FDA, EMA, NABL, and WHO.

Turning Points:

Early adoption of pharma analytical testing created long-term client stickiness in generics and biosimilars.

Divestment of the diagnostics business to Thyrocare in 2024 sharpened focus and freed up capital.

New life sciences and electronics testing facilities came online in 2025, signalling intent to scale across adjacencies.

Now, the biologics Contract Research, Development, and Manufacturing Organization (CRDMO) pivot stands as the boldest strategic move yet, designed to propel Vimta into high-growth, high-margin global markets.

How They Make Money (and Where)?

Think of Vimta’s business as a diversified “testing bouquet,” with revenue streams spread across high-margin pharma services and steady cash-flowing adjacencies.

Pharma Services: Preclinical, clinical, and GMP analytical testing (>60% of revenues). Includes bioavailability/bioequivalence studies, toxicology, and clinical trial management.

Food Testing: Ensures compliance for FMCG giants, exporters, and agri value chains.

Environment Testing: Compliance-driven; environmental clearances, ESG-related audits, and water/soil testing.

Electrical & Electronics Testing: EMI/EMC labs serving defence contractors, consumer electronics, and auto electronics.

Revenue Split (FY25):

Total Income: ₹344 Cr.

Pharma & clinical research: dominant, but food and electronics are steadily rising niches.

Overseas clients contribute ~75% of clinical research revenues.

Margin Drivers:

Pharma research: high EBITDA margins (30%+).

Food/environment: steady but lower-margin (~15–20%).

Electronics: asset-heavy but scalable, with sticky industrial clients.

The Bigger Picture – Industry Lens

Global Economy Outlook

Pharma R&D outsourcing is accelerating globally, particularly in biologics and biosimilars. The biologics market alone is expected to grow at an 8.2% CAGR to hit $653B by 2030.

Indian Economy Outlook

India’s cost advantage, skilled talent pool, and regulatory reforms (NDCT, IVD protocols) are positioning it as a global testing hub. Hyderabad’s Genome Valley is fast emerging as the biotech capital of Asia.

CRO Market

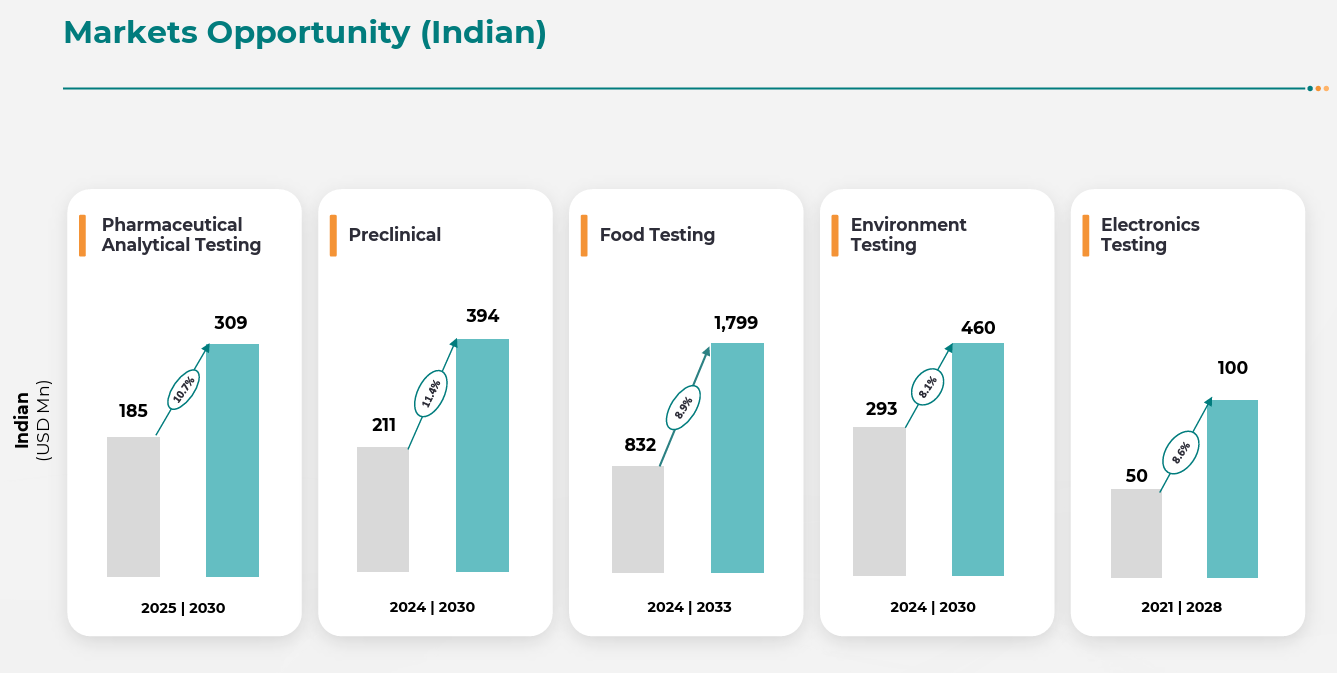

India’s CRO market is expected to grow at a 10.75% CAGR till 2030, fueled by multinational outsourcing and indigenous drug development.

TIC Market

The Testing, Inspection, Certification industry is thriving on stricter regulations in pharma, food, electronics, and the environment.

Pharma Analytical Testing

Still the backbone of Indian CROs, essential for generics and biosimilars. Vimta has four decades of expertise and global accreditations.

Food Testing

Temporary slowdown due to facility transitions, but expected to stabilize. Growing demand from processed foods, exports, and domestic FMCG majors.

Electrical & Electronics Testing

Government’s Make in India, defence indigenization, and EV push create a significant growth runway. Vimta is among the first movers in EMI/EMC private testing capacity in Hyderabad.

Environment Testing

Climate commitments, ESG pressures, and stricter pollution norms have made this a rising compliance-driven vertical.

Numbers That Matter (Quarterly Results)

Q1 FY26 was a record breaker:

Revenue: ₹98 Cr, (up 30.3% YoY & 3.30% QoQ)

EBITDA: ₹34 Cr, margin 35.7%.

PAT: ₹19 Cr, margin 19%. (up 35.9% YoY & 3.11% QoQ)

EPS: ₹4.2 vs ₹2.7 YoY. (up 88% YoY & 3.40% QoQ)

FY25 (full year):

Revenue: ₹344 Cr (YoY +19.20%).

PAT: ₹67 Cr. (YoY +36.8%).

EBITDA Margin: 35.5%.

Balance sheet:

Net-debt free with ₹374 Cr. in cash.

Borrowings Decreased to High Single Digits

So, what the numbers tell us ?? Well I Think Vimta is scaling efficiently, keeping margins strong even during capex-heavy growth. Few mid-cap Indian CROs have posted >30% EBITDA consistently.

Key Catalysts I’ll Watch

Divestment of Diagnostics (2024): Sold to Thyrocare, boosting focus and profitability.

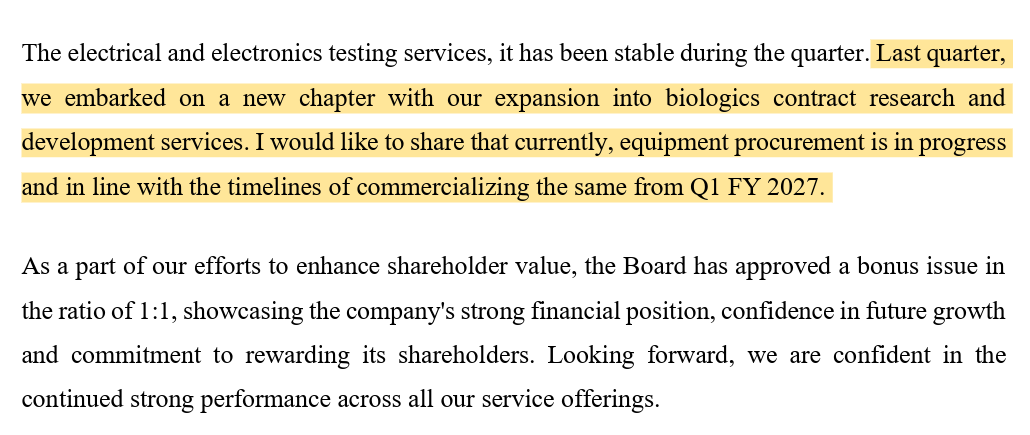

Bonus Issue (2025): 1:1 issue, improving liquidity and sentiment.

Capex: FY26 allocation ~₹80–100 Cr, primarily for biologics setup, digitization, and automation.

Regulatory Tailwinds: NDCT rule easing, CDSCO/ICMR protocols, BIOSECURE Act inquiries from MNCs.

New Facilities: Life sciences & electronics labs commissioned in 2025, anchoring future growth.

Despite capex intensity, management floated the possibility of doubling turnover in three years.

What Management Thinks (and Plans)

From Q1 FY26 Con-Call:

Biologics: Commercial launch by Q1 FY27, with offerings spanning from characterization to formulation.

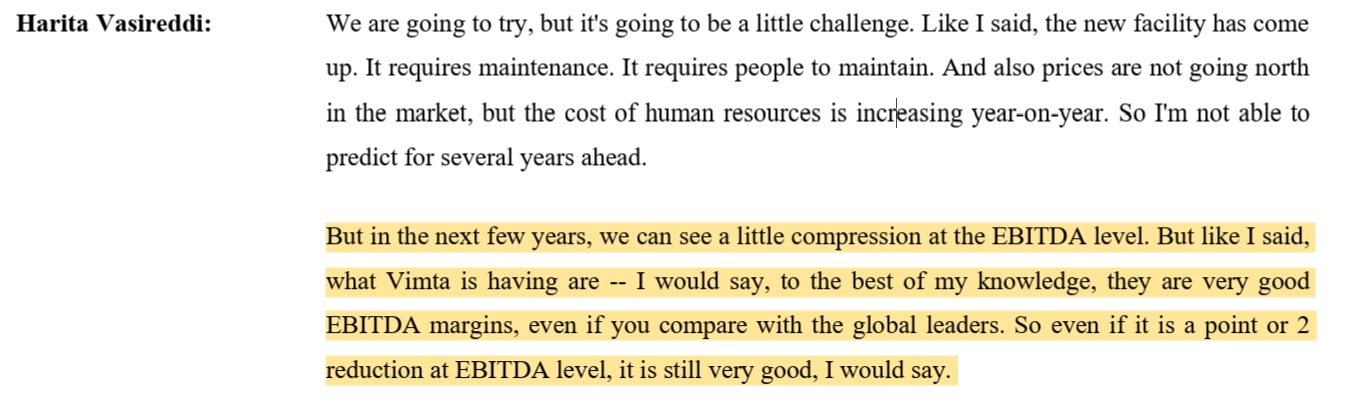

Margins: Current 35%+ may compress by 1–2%, but will remain competitive globally.

Clinical Trials: Pipeline described as “encouraging,” FDA inspection cleared with no 483 observations, and ~75% of revenue comes from overseas clients.

Run-Rate: Reaffirmed ₹120–125 Cr per quarter.

Growth Outlook: Long-term 15–20% CAGR expected post-biologics commercialization.

I felt after hearing Con-Call Management is Confident yet Pragmatic, measured, and focused on sustained rather than flashy growth.

The Big Money Plans – Capex & Fundraising

FY26 Planned Capex: ~₹80–100 Cr.

Biologics expansion is the centrepiece, alongside automation and capacity expansion.

Borrowing limits raised to ₹300 Cr, signalling ambition to scale aggressively.

Management is clearly betting its chips on biologics + automation for the next decade.

Risks & Valuations

Obvious Risks:

Margin compression due to rising HR and maintenance costs.

Biologics adoption is slower in India compared to peptides.

Execution risk in scaling new verticals.

Underrated Risks:

Reliance on pharma outsourcing cycles that can fluctuate.

Regulatory implementation delays despite reforms.

Competition from deep-pocketed global CRO/CDMOs.

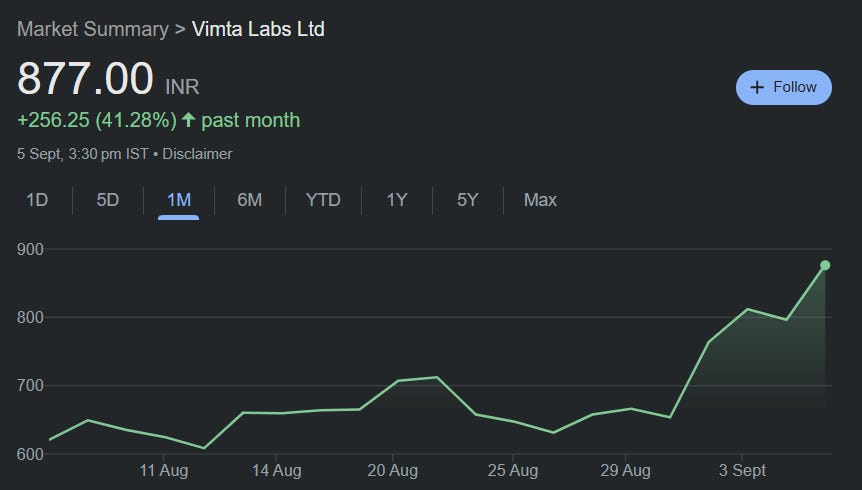

Valuations: With stock up 42% in one Month, near-term optimism is largely priced in. However, long-term biologics/CDMO optionality may still be underappreciated.

Con-Call Goldmine

Analysts were persistent on margin queries, showing skepticism on sustainability, despite a strong operational history.

Let’s Understand Competitive Arena

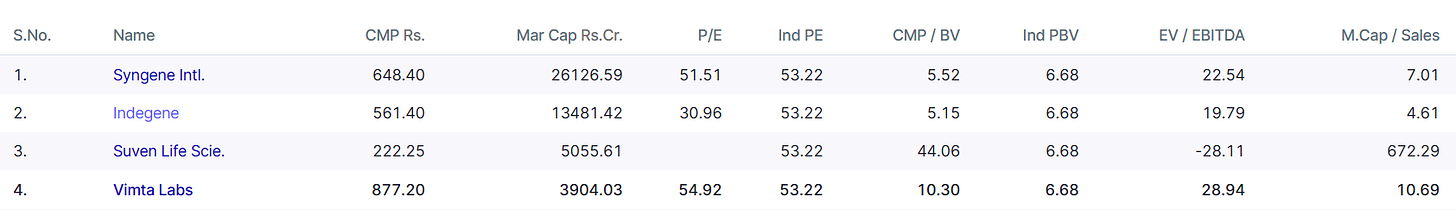

Peers: Syngene, Suven Pharma, Eurofins, SGS.

Strengths:

Diversified business mix (pharma + food + electronics).

Early mover in EMI/EMC private capacity.

Net-debt free balance sheet.

Challenges:

Smaller scale vs global CRO/CDMOs.

Heavy capital expenditure commitments.

Need to establish credibility in biologics against entrenched leaders.

Yet, Vimta’s focused niche strategy and regulatory credibility give it a defensible moat.

Regulatory Tailwinds – A Separate Spotlight

NDCT Rule Amendments (Aug 2025)

Labs can start testing after notifying regulators; a license is required only for high-risk drugs.

Cuts approval timelines by up to 90 days.

Reduces license applications by 50%.

Aligns India with US FDA/EMA standards.

CDSCO/ICMR IVD Protocols

Introduces standardized norms for diagnostic devices.

Improves global trust in Indian diagnostics.

Spurs outsourcing and boosts demand for accredited labs.

Government Schemes

BIRAC – Biotechnology Ignition Grant (BIG): Supports startups with early-stage funding.

PLI Scheme: Encourages local diagnostics and pharma manufacturing.

Together with, reforms + schemes strengthen India’s CRO ecosystem, creating fertile ground for companies like Vimta.

How Will These Policies Play Out in Practice?

NDCT Rules:

Labs conducting BA/BE studies can begin operations by simply notifying the regulator rather than waiting 90 days for approvals.

Licenses are now required only for high-risk drugs, cutting down application volumes by ~50%.

This shortens onboarding timelines, reduces bottlenecks, and accelerates drug development cycles for pharma clients.

CDSCO/ICMR IVD Protocols:

Creates clarity, uniformity, and stricter quality benchmarks in diagnostic testing.

Enhances trust in Indian-made diagnostic devices for global acceptance.

Spurs demand for certified testing services from CROs, as companies will need labs with NABL/GLP/GCP accreditations to validate products.

Together, these reforms enhance India’s global positioning as a credible clinical research hub—cutting red tape, improving quality assurance, and driving higher outsourcing volumes to players like Vimta Labs.

The Investor Sentiment Shift:

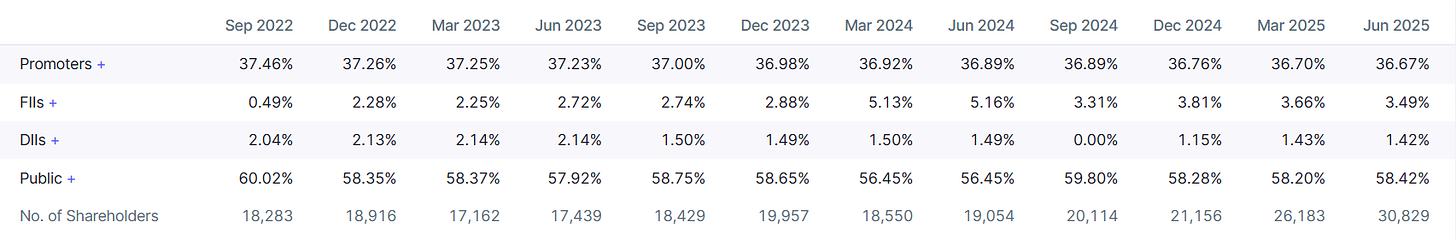

Promoters, FII and DII have reduced it’s Stake Slightly in the Company. It’s Backed by the Barclays Fund: Barclays Global Master Fund LP.

An indirect bet on this Sector or Company can be taken through the Passive Fund of the BSE Healthcare Index

The Big Picture Wrap-Up

Vimta Labs today is a company in transition. From food and environment testing to pharma CRO and now into biologics CDMO, it has steadily climbed the value chain.

Short term (FY26): Stable growth, driven by pharma testing, strong clinical trial demand, new electronics labs, and international clients (75% of CR revenues).

Medium term (FY27): Biologics CRDMO launch becomes the game-changer. Revenue optionality expands into a high-growth, high-margin space.

Long term (beyond FY27): If executed well, Vimta could scale into one of India’s few globally competitive CRO/CDMOs, riding on regulatory tailwinds and India’s cost/talent advantage.

Technical Setup: (Bonus: If you came this far reading)

My Technical Take:

Price Action Analysis:

- Current Price: ₹887.20

- 52-Week Range: ₹252 to ₹903

- Market Cap: ₹3,901 Crores

- Recent Performance: Stock has shown exceptional momentum with 180% returns in the past year

Volume Spread Analysis:

- Breakout Volume: Exceptional volume spike during the August 2025 breakout

- Volume Confirmation: Higher volumes on up-moves, lower on corrections

- Accumulation Phase: Steady volume during the consolidation phase indicates smart money accumulation

Chart Patterns:

- Long-term Ascending Trendline: Yellow trendline acting as dynamic support since May 2024

- Parallel Channel Breakout: Stock consolidated in a 6-month parallel channel (₹400-550) from December 2024 to July 2025

- Flag and Pennant Formation: Classic continuation pattern post Q1 FY26 results

- Volume Breakout: Massive volume surge accompanying the breakout, confirming genuine momentum

Key Technical Levels:

- Base Formation: ₹400-450 level established during Dec 2024 - Jul 2025 consolidation

- Primary Support: ₹550-600 (previous resistance turned support)

- Secondary Support: ₹500 (parallel channel upper boundary)

- Immediate Resistance: ₹700-750 (psychological levels)

- Final Resistance: ₹900-1000

Link to the Full Idea:

My 2 Cents:

I remain bullish but patient. With stock already up 180% YoY, much near-term optimism is priced in. The true inflection lies ahead—Q1 FY27 onwards, when biologics commercialization starts. Until then, investors must weigh stellar execution in core pharma services against the long wait for the biologics payoff.

What I’ll Track Next:

Commissioning of the biologics facility and initial client wins (Q1 FY27).

Margin trajectory as costs rise from capex and headcount.

Stabilization of food testing and ramp-up in electronics/EMC.

Clinical trial pipeline conversions, especially from MNCs post-BIOSECURE Act.

Signs of global partnerships or JV opportunities in biologics CDMO.

Vimta is no longer just “a lab.” It’s India’s silent disruptor—quietly building the scaffolding for the next global CRO story.

This Week’s Recommendation:

Neelkanth Mishra, a well-known personality in the world of economics, offers his insights on the current geopolitical and macroeconomic landscape, providing a crucial perspective for understanding India's economic pulse, market strategies, and overall stability

Watch the Discussion on continued global uncertainty, impact of US tariffs on India, de-dollarization, India's perceived GDP growth versus ground realities

This is a must-watch for anyone trying to navigate the volatile world of markets, strategy, and stability.

Disclaimer:

As per the Latest SEBI Mandate, this isn't a Trading/Investment RECOMMENDATION nor for Educational Purposes; it is just for Informational purposes only. The chart data used is 3 Months old, as Showing Live Chart Data is not allowed according to the New SEBI Mandate.

I am not a “SEBI-registered research Analyst and Investment Adviser”

This analysis is intended solely for informational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor and conduct thorough research before making any investment decisions.

✉️ Enjoyed this? Please Hit Like and Restack. Hit subscribe for more clear, no-fluff breakdowns of India's hidden gems and high-growth bets.

📩 Want this in PDF or with segment-wise visuals next time? Let me know.

📬 Like this post? Drop your thoughts in the comments! 💬📢💡

If you found this useful and enjoyed this newsletter, don’t forget to

Subscribe for weekly insights, and share them with a fellow market nerd.

Like your work keep doing. I am young entrepreneurs I want to connect with you

Invested. 25% up.